Guaranteed Draw

Learn the definition of a commission draw, including its purpose, benefits and disadvantages, along with an example to demonstrate the concept in the workplace. A draw against commission is a type of incentive compensation that functions as guaranteed pay that sellers receive with every paycheck. The draw amount is typically pre.

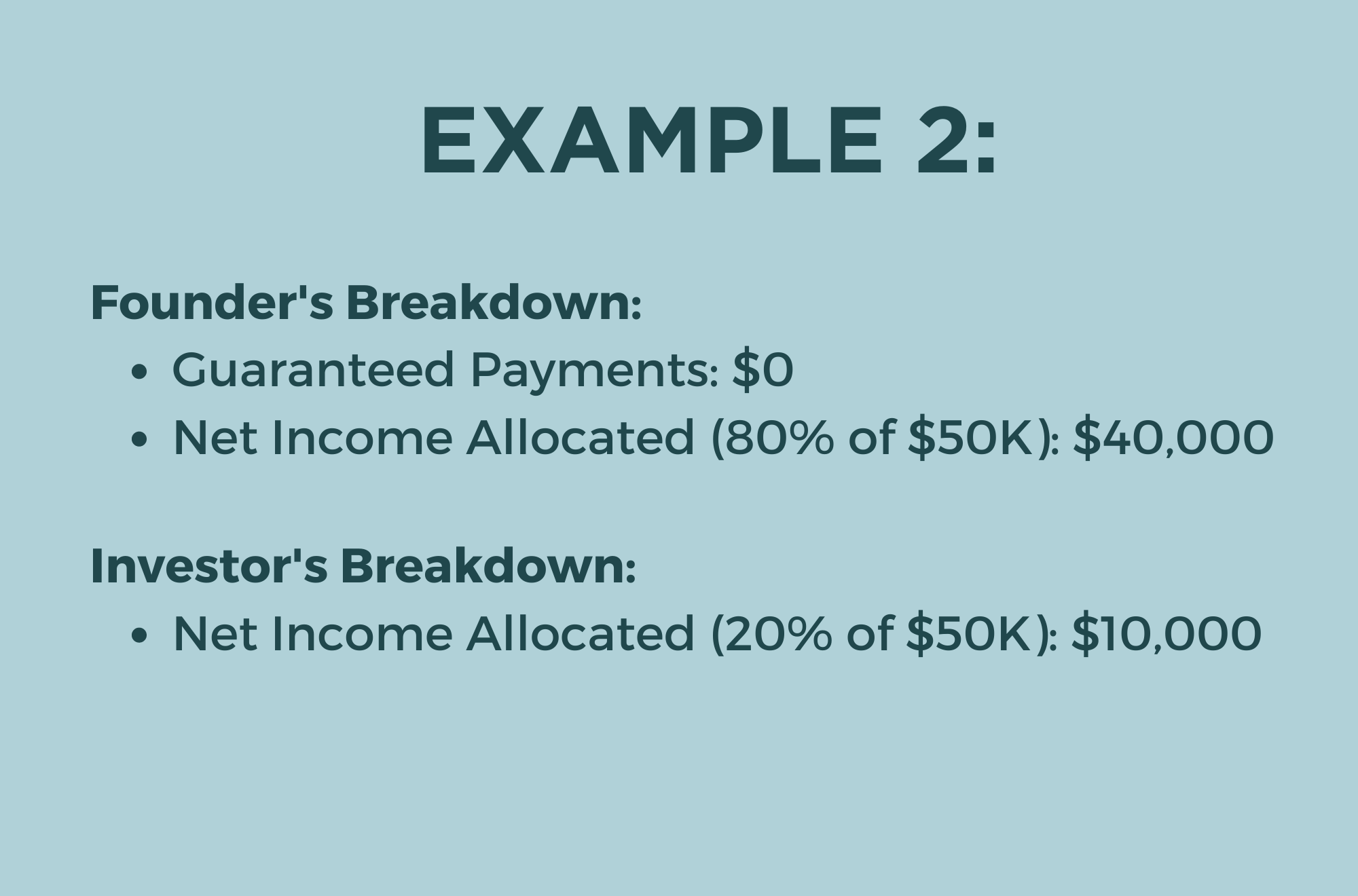

Is your small business faced with the tough question: guaranteed payments or draws? We share with you when to start making guaranteed payments, investor considerations and founder considerations. A draw against commission is a type of compensation structure that provides a guaranteed amount of pay in advance for each paycheck. It acts similarly to a cash advance for sales representatives.

100% Guaranteed Winners Competition! Plus £1000 Main Prize Draw ...

Learn how draw against commission works, its benefits, risks, and how it affects your earnings as a commission. Do you know what a recoverable or non-recoverable draw is? and when to use it? Draws can be leveraged to enhance your sales compensation program. Discover how and when to use draws to create a competitive sales incentive program.

A guaranteed draw is a set amount of money paid to a salesperson each pay period, regardless of the commissions earned. If commissions exceed the borrowed amount of the draw, the salesperson receives the higher amount. Guaranteed Draw means an advance of principal in respect of the Term.