Free Mo State Tax Filing

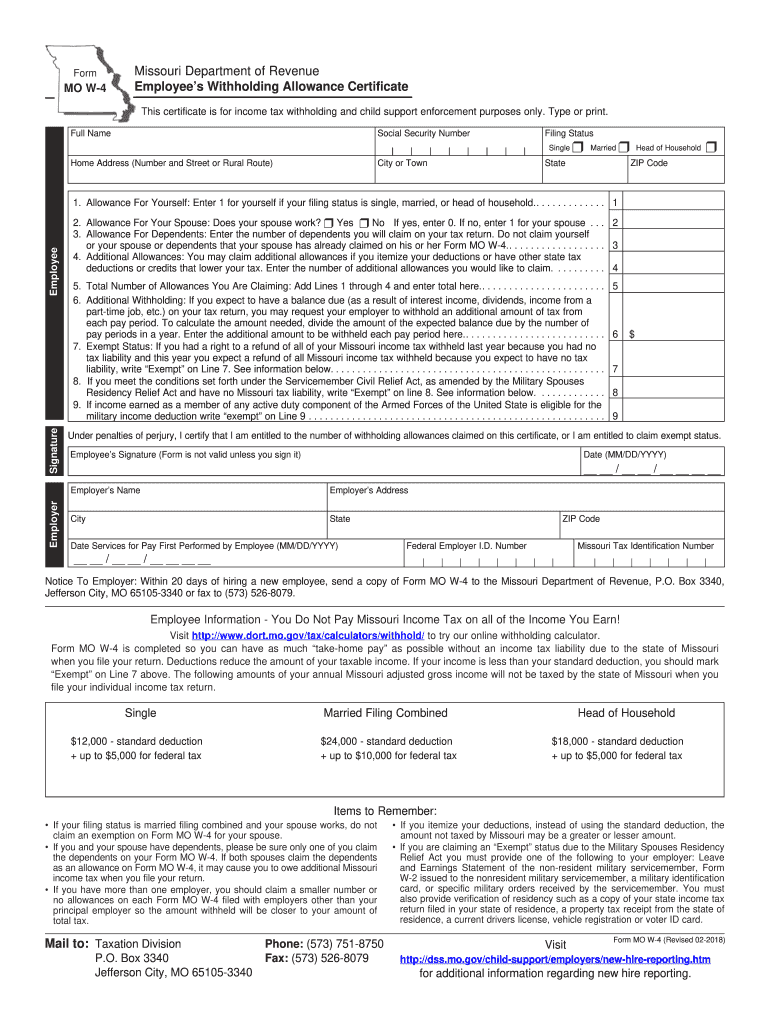

Information and online services regarding your taxes. The Department collects or processes individual income tax, fiduciary tax, estate tax returns, and property tax credit claims. File your taxes for free.

New for 2024, MyFreeTaxes is an online service brought to you by United Way where you can prepare and file your own taxes, completely for free. If you get stuck, the IRS provides support through phone or virtual meetings to help you complete your return. If you live in Missouri, you can get your taxes prepared and filed for free.

Free state income tax filing (5 ways to file free) | Filing taxes ...

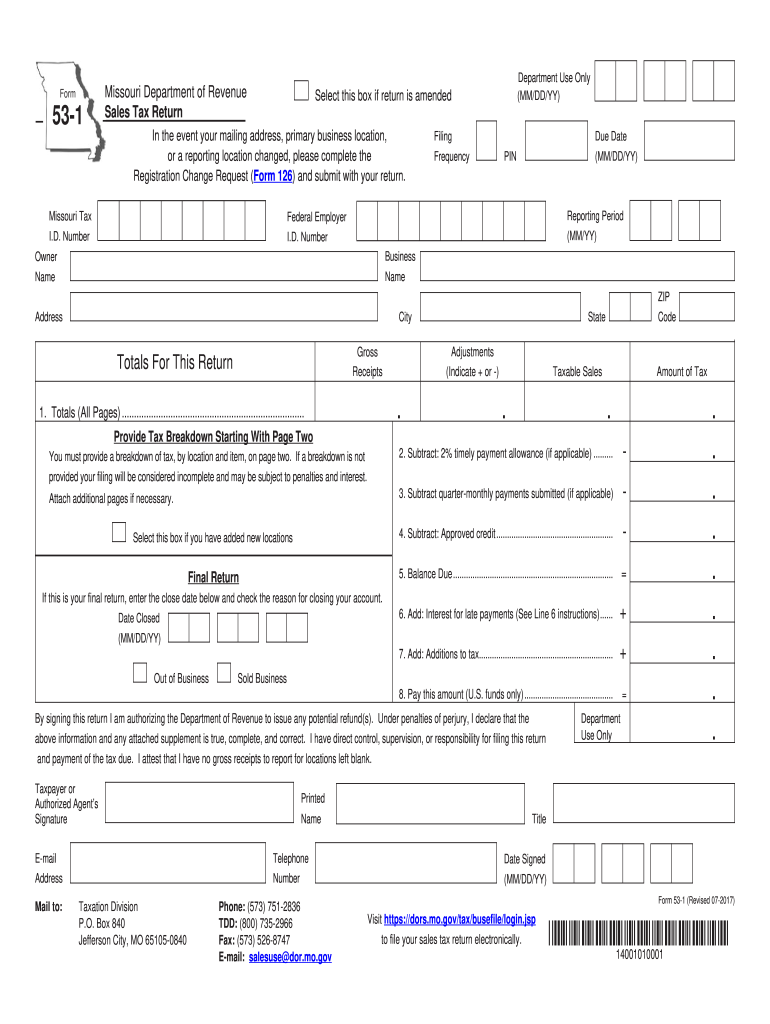

The Missouri Department of Revenue contracted with some tax-preparation software providers to give online services to taxpayers who qualify. Known as the Free File Alliance, the agreement provides details on each plan in the program. 100% free federal tax filing.

E. F ree federal and MO tax preparation & e-file for all who live in MO with an Adjusted Gross Income (AGI) of $32,000 or less. This offer is limited to three (3) free tax returns per computer.

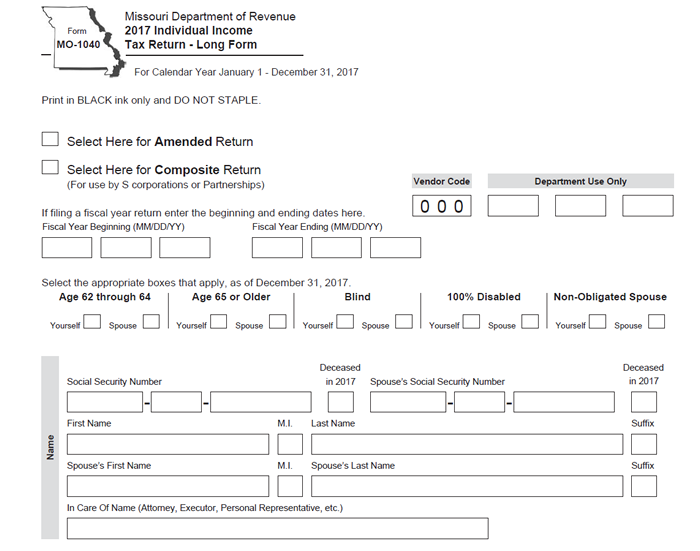

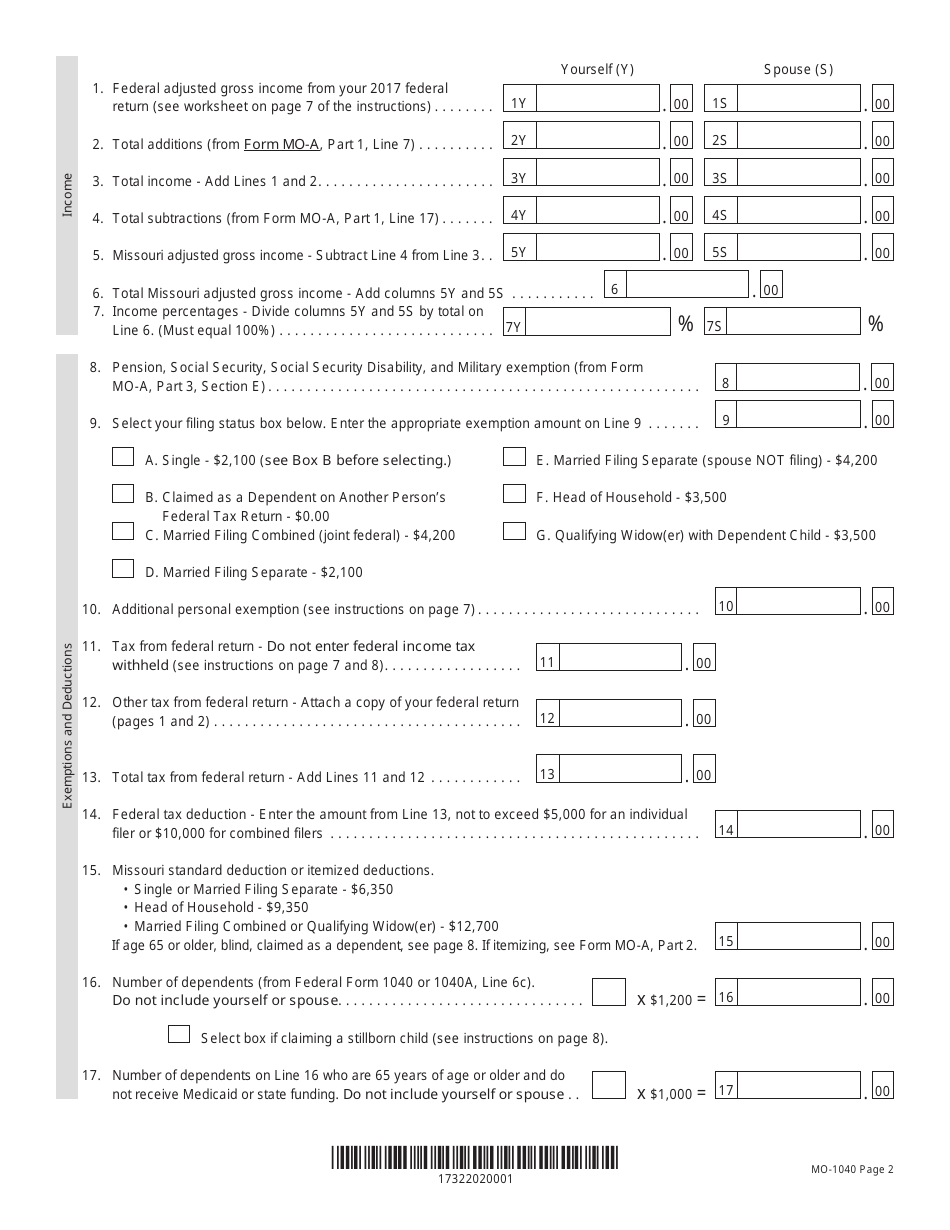

Form MO-1040 - 2017 - Fill Out, Sign Online and Download Printable PDF ...

Free Online Filing Providers Online Filing Providers Due Date The due date for the 2024 Missouri Individual Income Tax Return is April 15, 2025. File Individual Income Tax Return New This online filing method is available for use by taxpayers who: Have a filing status of Single Earned income from wages reported on Form W-2 Were a Missouri resident, nonresident, or part year resident with. Learn how to file your Missouri state taxes online for free, check eligibility for no-cost options, and ensure your submission is accurate and accepted.

Here's how taxpayers in Missouri and Illinois can file for free. The IRS expects more than 140 million tax returns will be filed by the April 15 tax deadline. Missouri taxpayers who earned $32,000 or less in 2022 can receive free federal and state tax preparation and e.

Fillable Online Missouri Tax Forms 2022 : Printable State MO-1040 Form ...

The Missouri Department of Revenue Taxation Division administers Missouri tax law.