Intuit Quickbooks Payroll Annual

Intuit has rolled out pricing changes for Payroll effective August-December of 2025. The table below outlines changes and dates per QuickBooks version. If you have [].

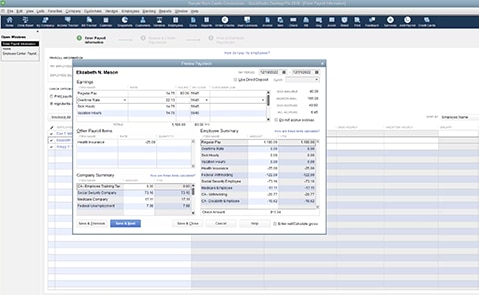

All QuickBooks Desktop Enterprise subscriptions (Silver, Gold, Platinum, and Diamond) will continue to be available for purchase for new subscribers after July 31, 2024.* Enterprise Gold, Platinum, and Diamond include integrated payroll. What actions to take. The QuickBooks Payroll Annual Fee Enhanced service offers basic payroll features, such as calculating paychecks and taxes, paying employees via direct deposit or check, and filing and paying taxes.

Payroll for Accountants, QuickBooks Payroll Solutions | Intuit

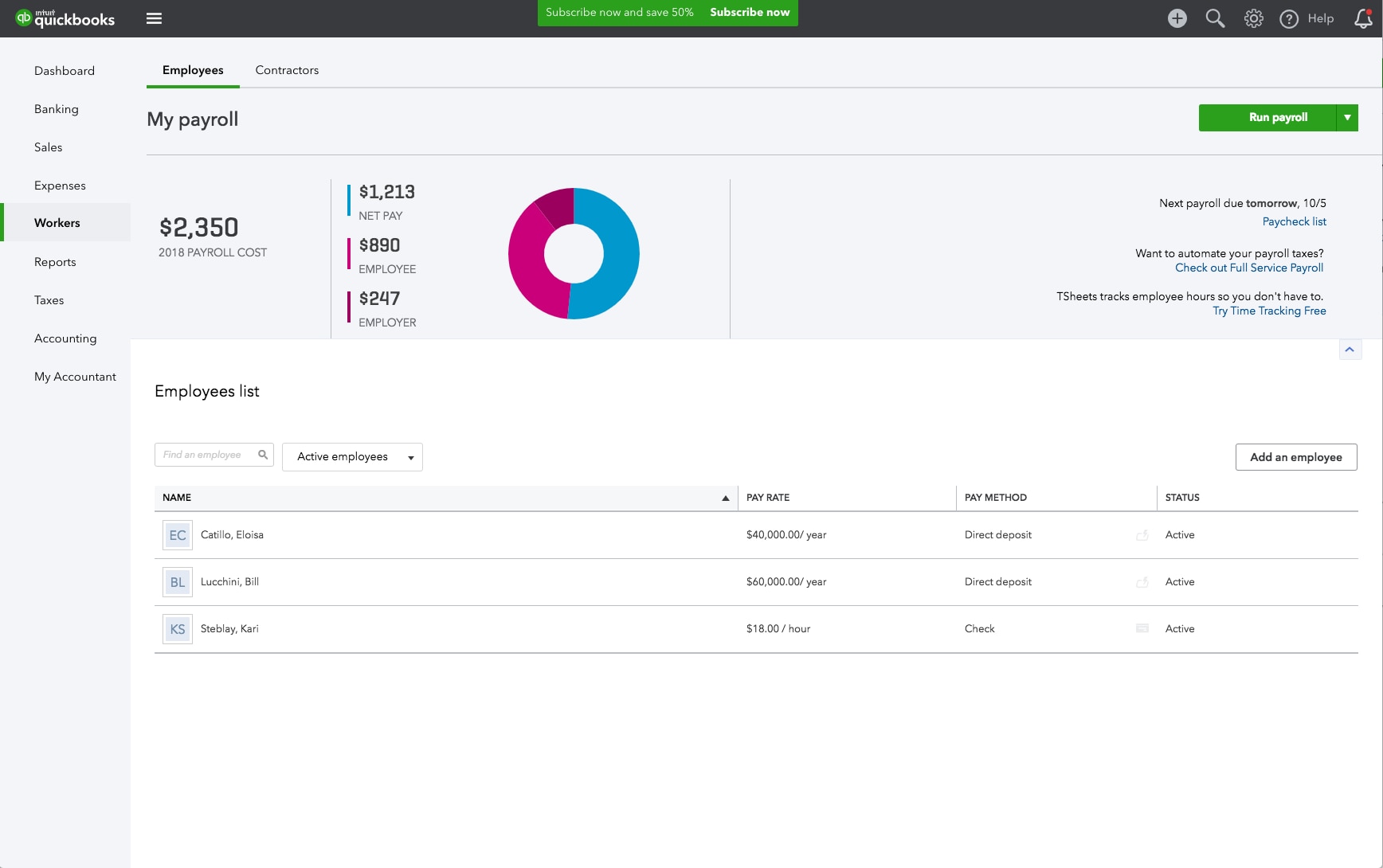

This service is designed for businesses that have simple payroll needs and do not require advanced features. QuickBooks Payroll costs depend on if you use QuickBooks Online or QuickBooks Desktop. about Intuit Payroll pricing for your business.

QuickBooks Desktop users may find that it saves both time and money to use the Quickbooks payroll integration for free tax forms, instant paychecks, and e-filing. Advertiser Disclosure: Our unbiased reviews and content are supported in part by affiliate partnerships, and we adhere to strict guidelines to preserve editorial integrity. QuickBooks Desktop Payroll is designed for small businesses.

Payroll for Accountants, QuickBooks Payroll Solutions | Intuit

We compare the three levels of service, Basic, Enhanced, and Full Service, which are offered by Intuit. Compare QuickBooks vs Intuit Payroll What is better QuickBooks or Intuit Payroll? With various functionalities, pricing, details, and more to evaluate, finding the right Accounting Software for your business is tricky. Get a clear breakdown of QuickBooks Payroll pricing plans, compare options, and find the best fit for your team's budget and requirements.

Intuit QuickBooks Online Payroll has three plans: QuickBooks Payroll Core, QuickBooks Payroll Premium, and QuickBooks Payroll Elite. All three offer full. Intuit® will e-file and e-pay federal, state taxes, quarterly and annual payroll tax returns, including year-end processing of W-2s.

Intuit QuickBooks Small Business Index Annual Report 2025 | QuickBooks

On the other hand, Enhanced payroll for accountants is ideal for those clients who want to process their payroll, as well as e-file and e-pay federal, state taxes, and quarterly and annual payroll tax returns.