Chart Of Debits And Credits

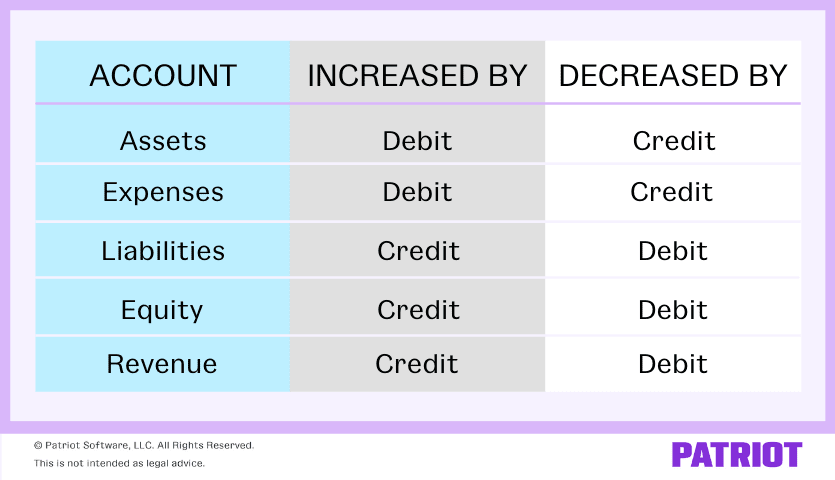

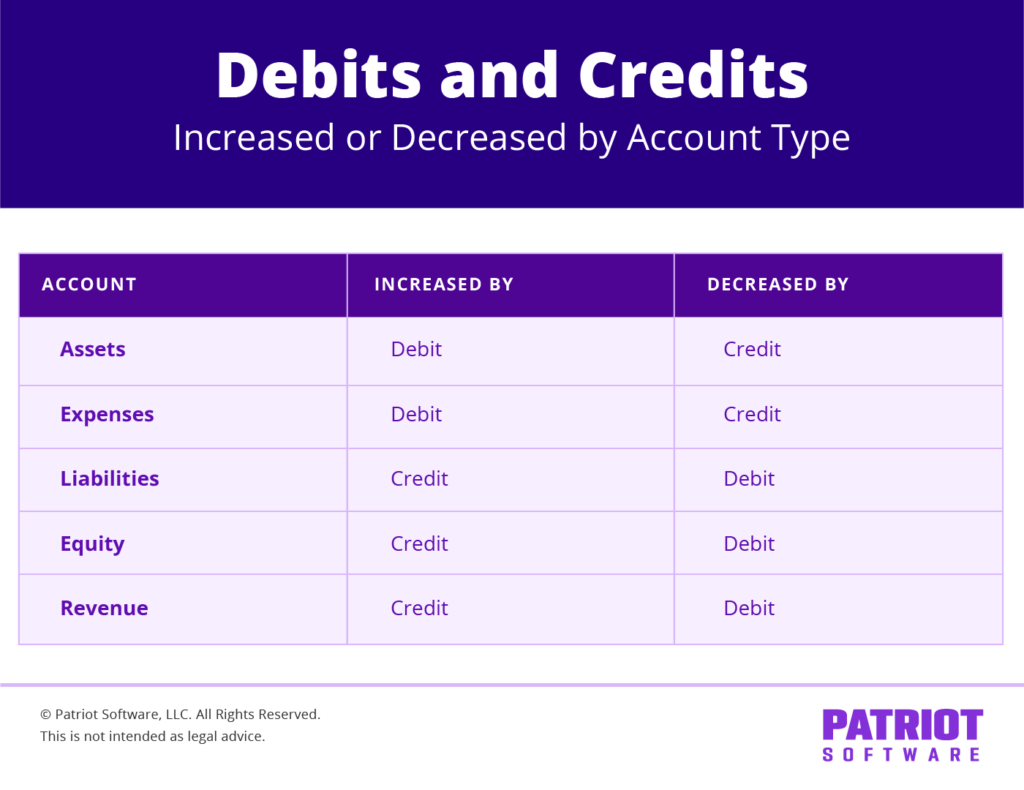

Learn the difference between credits and debits in accounting while getting your hands on a useful cheat sheet to help you along. An interactive debits and credits chart. Use this handy reference to show you the effect on accounts of debits and credits bookkeeping entries.

Common Mistakes You Should Avoid While Recording Accounting Debit Credit Cheat Sheet Posting the debits and credits accurately is significant to keep your financial accounts balanced and to maintain the records for future reference. While Assets, Liabilities and Equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction occurs. Credit vs Debit - What's the Difference? The double entry accounting system is based on the concept of debits and credits.

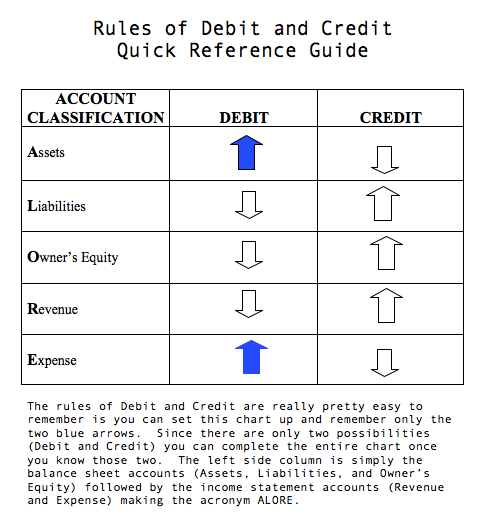

General Rules for Debits and Credits | Financial Accounting

Learn what accounts use both. Learning your debits and credits is essential to learning this task. Also becoming familiar with your chart of accounts and how to read financial statements helps if you want to master small business bookkeeping.

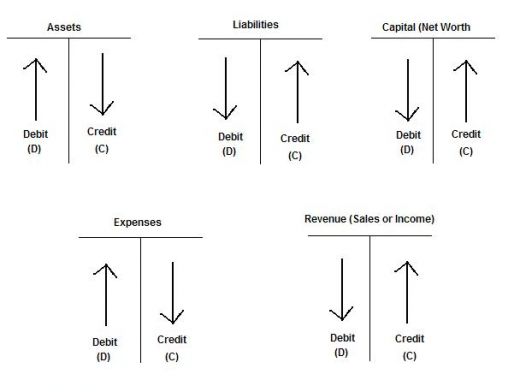

Another great tool to use when working your way through a complicated entry are "T-accounts". A simple, visual guide to debits and credits and double. Explore the key accounting terms debits and credits and how to record transactions in a firm's general ledger with the double.

Accounting Basics: Debits and Credits

Every time a debit increases or decreases the value of one general-ledger account, there is a corresponding credit decrease or increase in at least one other account. Debits and Credits T-Chart A "T chart," also referred to as a "T-account," is a two-column chart that shows activity within a general-ledger account. The chart resembles the letter "t" in that the left column displays.

The Role of Debits and Credits in Bookkeeping Debits and credits form the foundation of the double-entry bookkeeping system. In this system, every financial transaction changes at least two accounts to keep the books balanced. A debit entry shows money entering or increasing certain accounts.