P Cards Vs Credit Cards

The right choice of credit cards depends on your specific requirements, spending patterns, and financial goals. Whether you're a startup looking to establish business credit or an established enterprise seeking to streamline procurement, knowing the key differences between p. For the merchant who accepts these cards the interchange rate and processing fee is higher than a normal credit card.

However the the card companies do a have special interchange for what is called "Large ticket transaction". Your credit card processor should be able to give you more information on the cost and processing procedures. Purchasing Card vs.

What Are Corporate Cards and How Do They Work?

Credit Card: A Comparative Analysis Flexibility in Spending Purchasing cards, offered by P-Card providers, stand out by allowing individual employees to spend according to company policy, rather than being confined by the predetermined credit limits of company credit cards or corporate charge cards. This adaptability facilitates smoother purchase transactions, enabling. Purchasing cards (or p-cards) are corporate credit cards that businesses can use to simplify their procurement processes.

Credit cards are the most-preferred way for businesses to pay suppliers. But it's worth considering other forms of payment, such as P cards. In this article, we'll break down what purchasing cards and credit cards are, their differences and why P.

P Cards Vs Credit Cards at Rebecca Montgomery blog

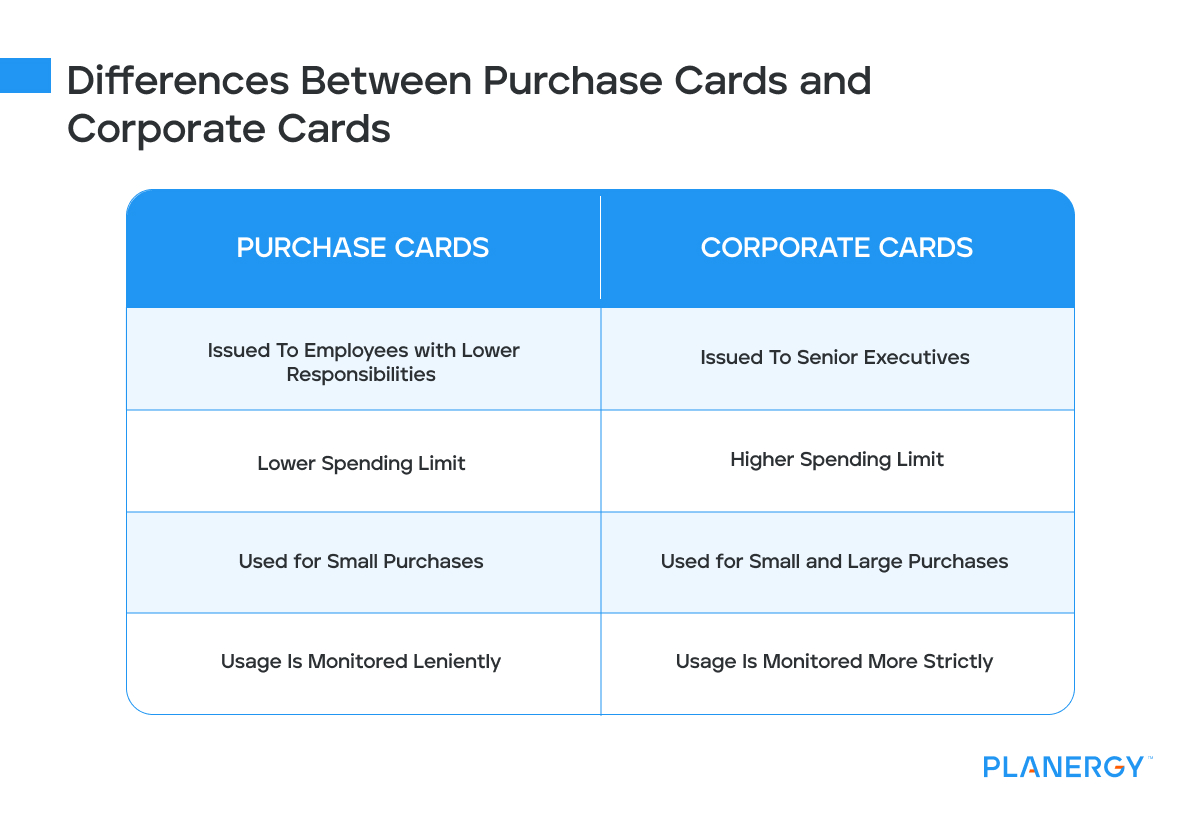

Both cards are aimed at reducing administrative routine and improving efficiency, but P-Cards focus on procurement rather than general expenses. How does it work in practice? For example, a traveler using a company procurement card can rent a vehicle or pay for a conference ticket, whereas a corporate credit card may cover only hotel rooms in business travel. What are p-cards? A purchasing card is a kind of commercial credit card.

Businesses give p-cards to employees to use for a specific procurement, like buying goods from the same vendor every month.

:max_bytes(150000):strip_icc()/Differences-between-revolving-credit-and-installment-credit_sketch_final-ccac21e2a4a94aeb90443ea2b92ec759.png)