Can You Claim Cheerleading On Taxes

If you spend money to support your child's football team, cheerleading squad or school drama club, you can claim that as a tax deduction. To qualify, it has to be paid to the school -- or another organization that qualifies you to take a charitable deduction -- and not your kids. Writing the school a check or donating equipment is a write-off, for instance; paying your child's membership fees.

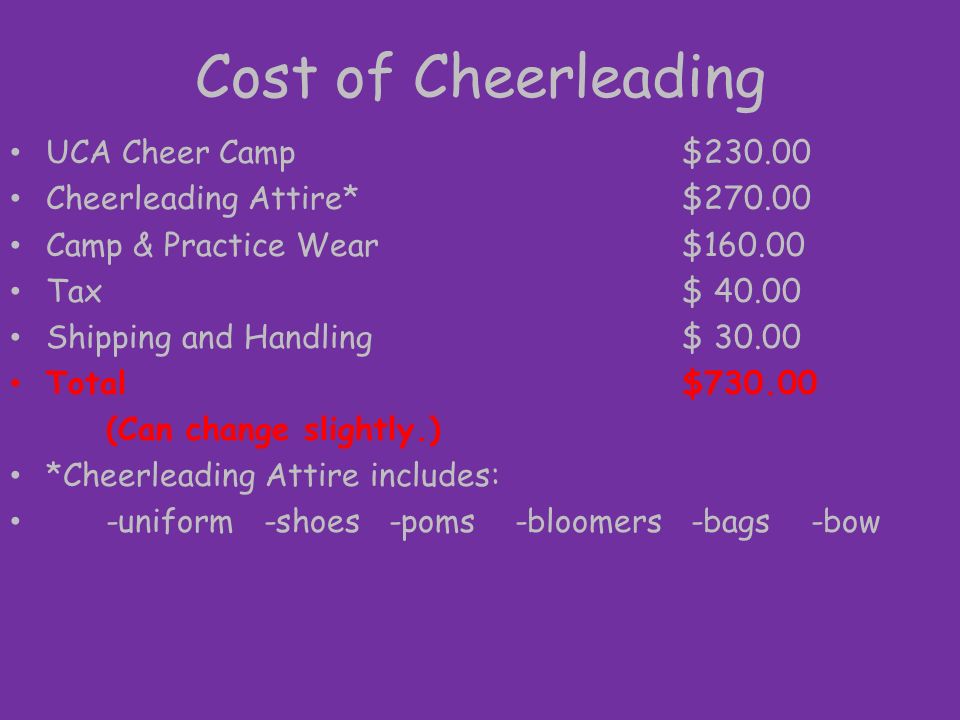

Parents often wonder if they can deduct the cost of their child's sports fees on their taxes. With rising expenses for equipment, league registrations, and travel, any potential tax break would be helpful. However, most youth sports fees do not qualify as deductible expenses.

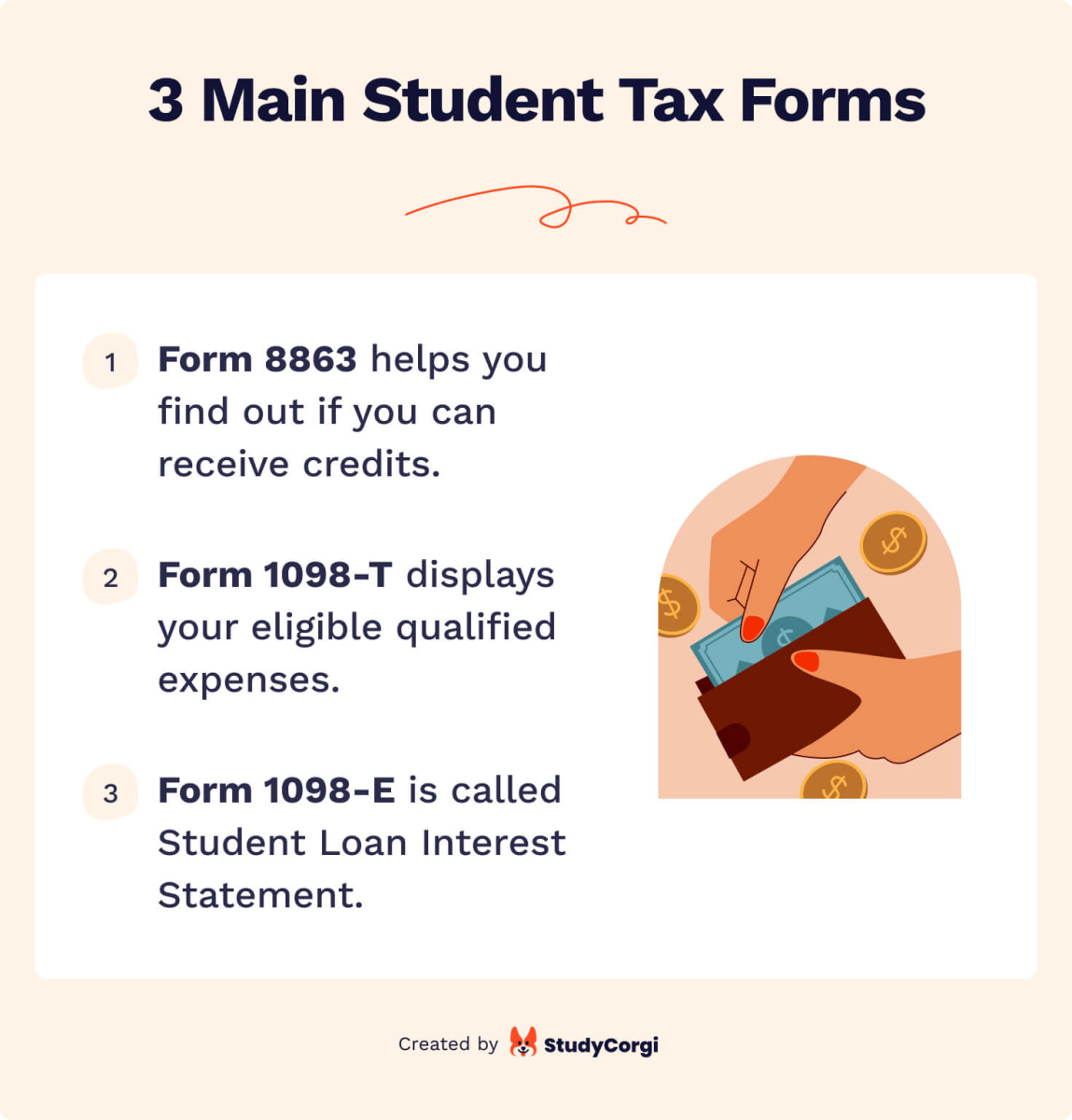

The Ultimate Tax Guide for Students: Tips, Tricks, & Helpful Info ...

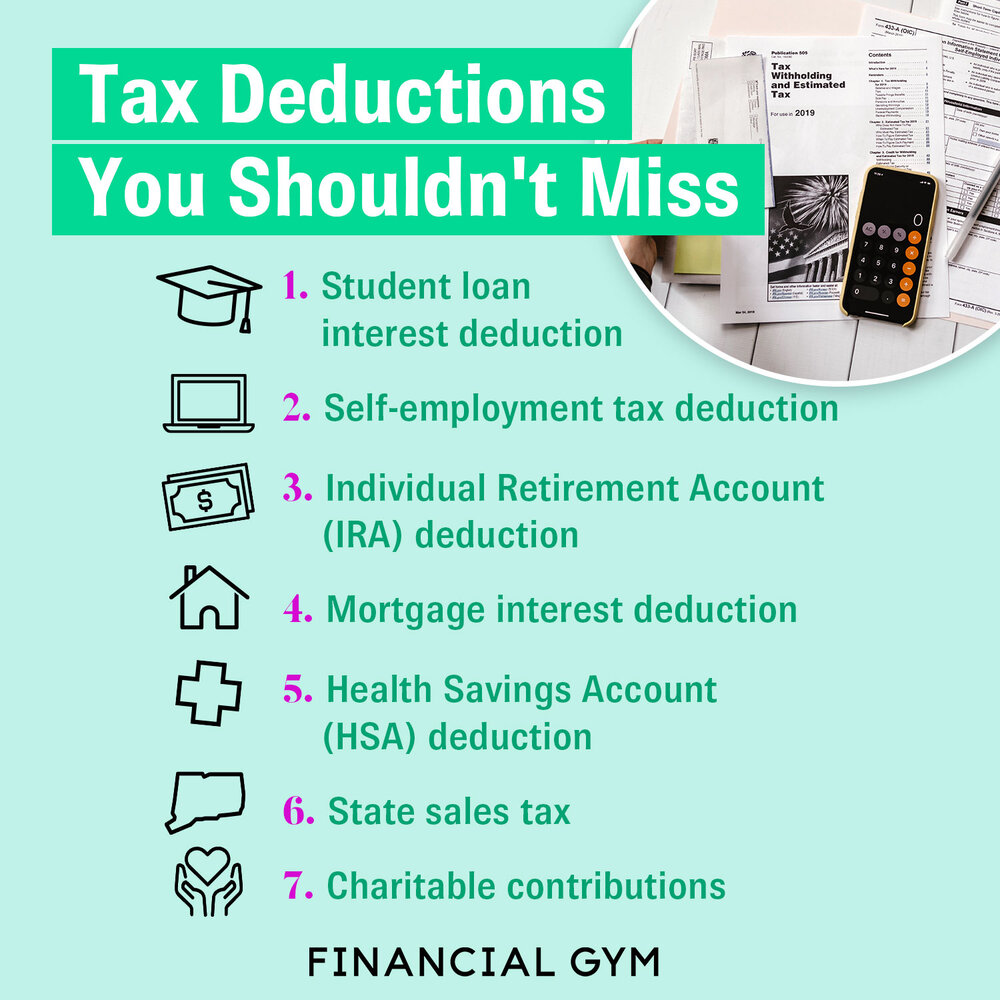

Claim credits and deductions when you file your tax return to lower your tax. Make sure you get all the credits and deductions you qualify for. How to Take a Write-Off for Child Enrichment Activities In order to claim a write-off, you'll need to make payments directly to the institution providing care and supervision.

This can be an after-school program, a local YMCA or day camp. It's also wise to stock away receipts and records regarding dates and times attended. Taxpayer asks: Hi, I am a stay-at-home from California and I have a daughter in Cheerleading.

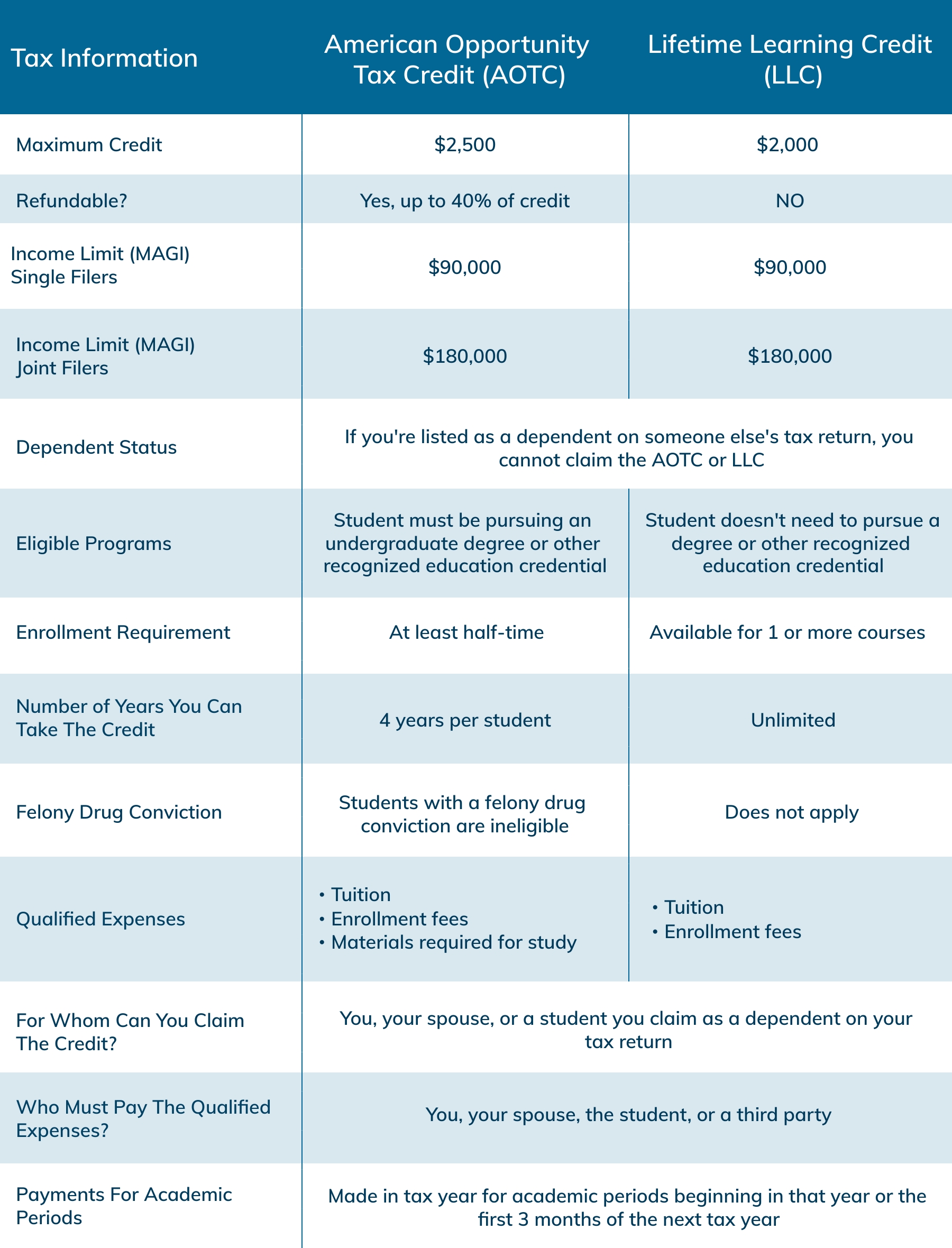

Education Tax Credits - Are You Eligible?

Can I deduct the expenses? She also attends a public school that requires uniforms - why can I not deduct those? Thank you so much, Taxgirl says: Nope, you can't deduct the costs associated with your daughter's cheerleading (unless this was professional cheerleading, which I am guessing it is. You can't deduct the out of pocket costs associated with afterschool or extracurricular activities like cheerleading, football, dance or soccer even if the programs are affiliated with school. My daughter dances full time after school every day and takes summer intensives during the summer.

Is her dance tuition tax deducible if both my spouse and I work full time? As a professional, your child can deduct any of his sports-related expenses against his sports income. Fees, equipment, travel and sports-related medical bills are all deductible. This doesn't translate into a write-off on your taxes, but at least you don't have to worry about paying his costs out.

Reporting Income (TAXES!) - ppt download

One common tax myth is the belief that you can deduct the cost of a child's extracurricular activities. This misconception can lead to incorrect deductions and potential issues with the IRS. Maybe.

If your kid is under age 13 and his participation during team practices/games is meant to allow you to work, then you could deduct up to $3,000. You'll have to include the taxpayer I.D. number for the sport organization on your tax return.

This deduction is also allowed for nursery school, day care, day camps, and before/after.