Accounting T Chart Examples

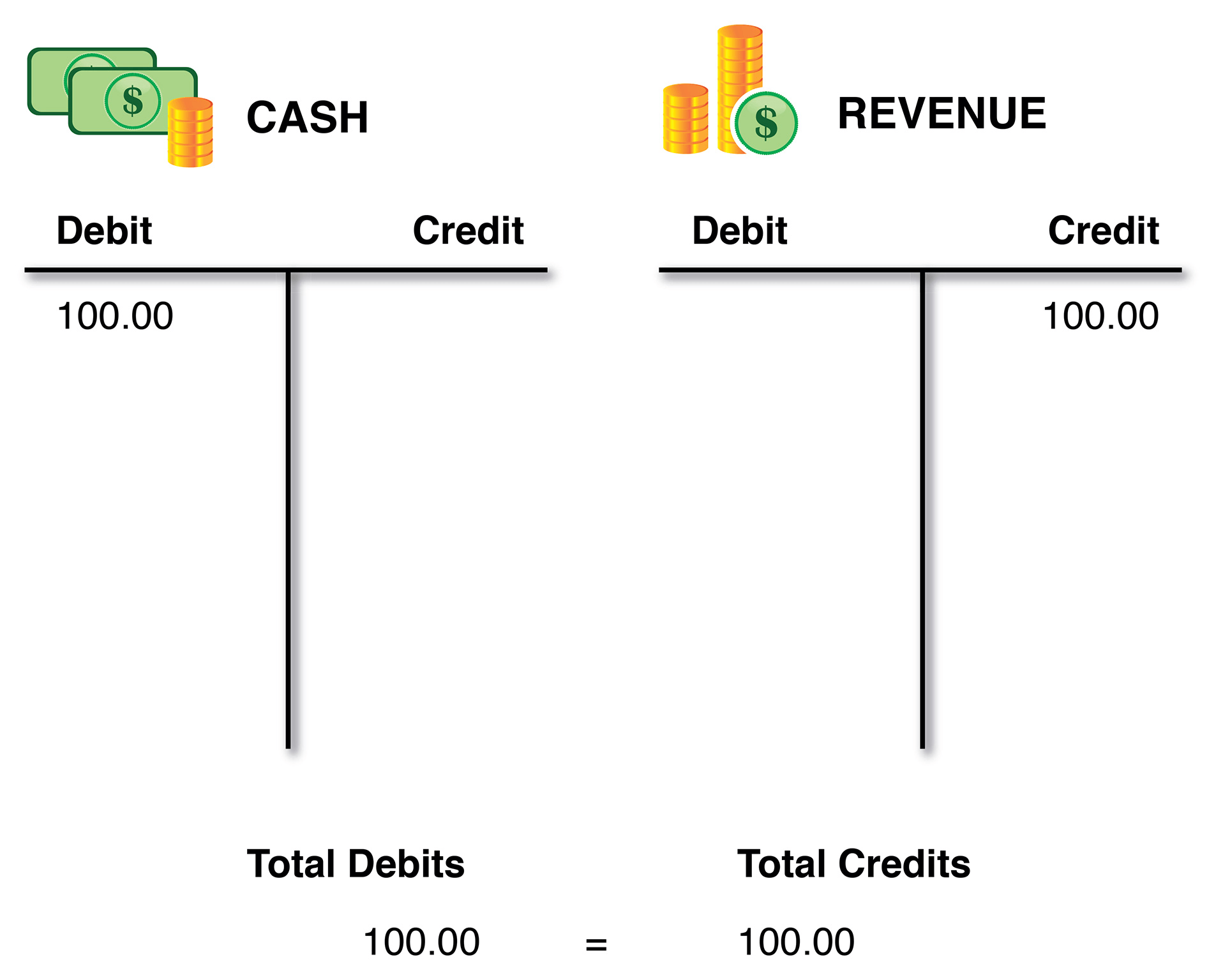

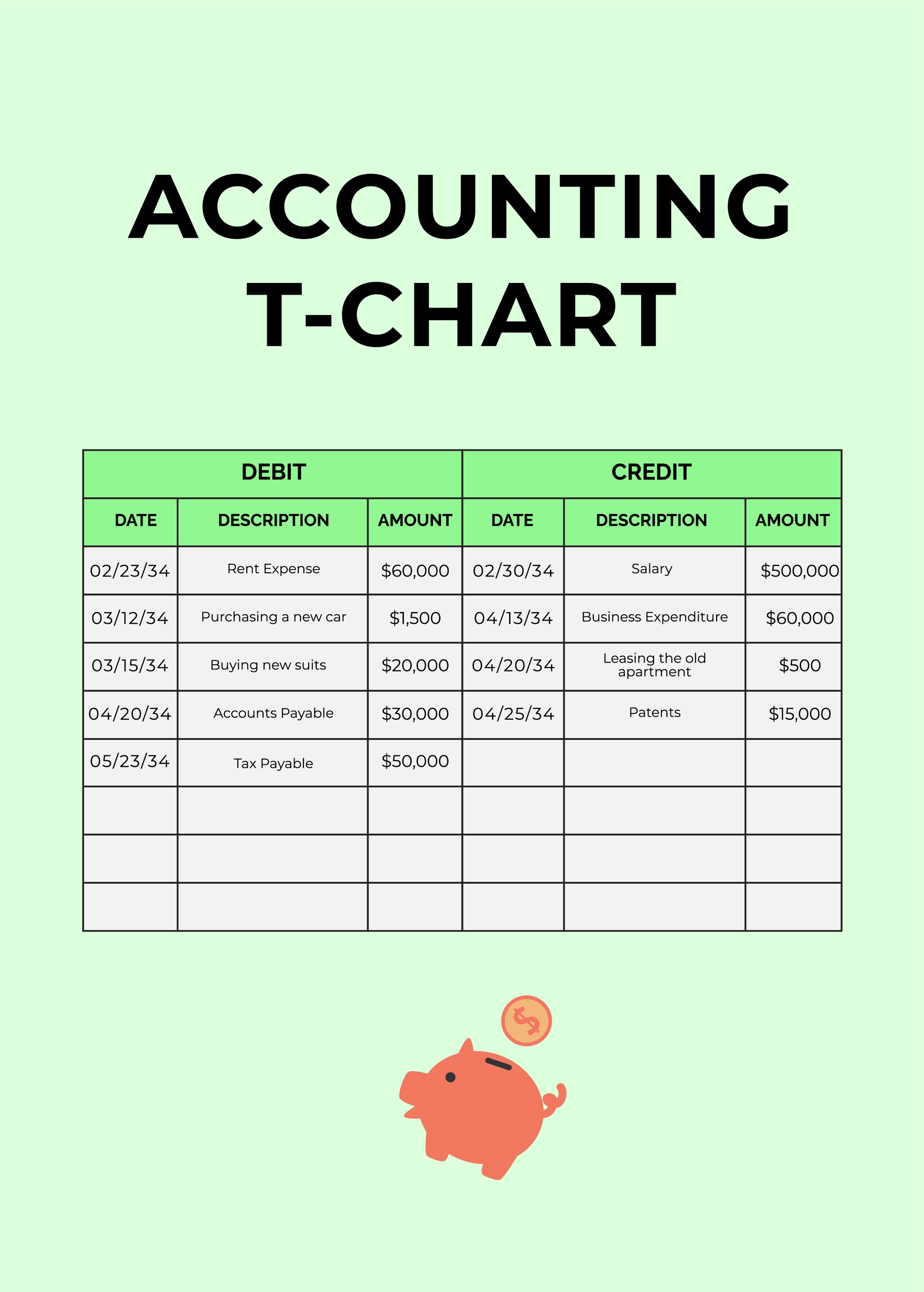

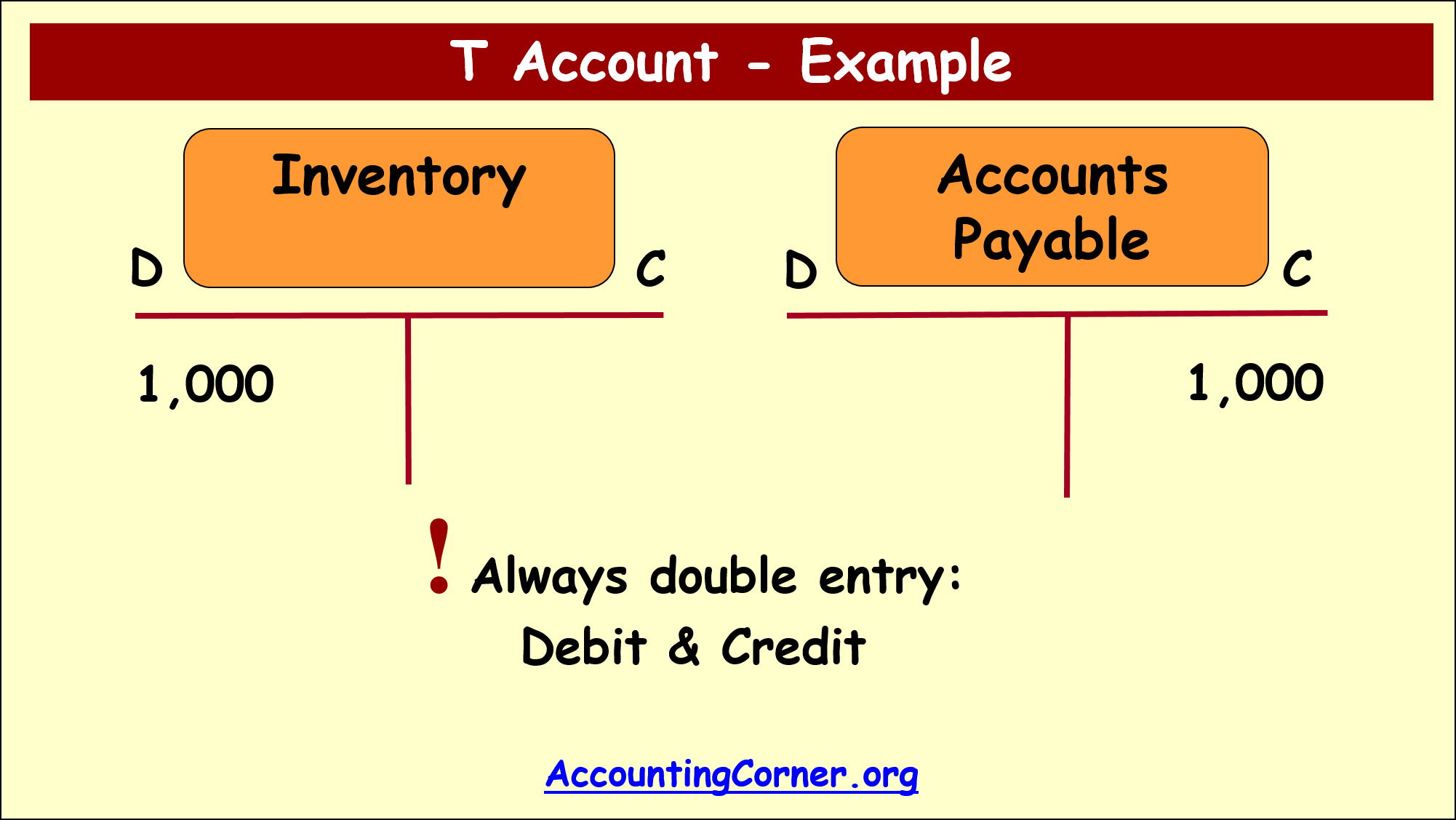

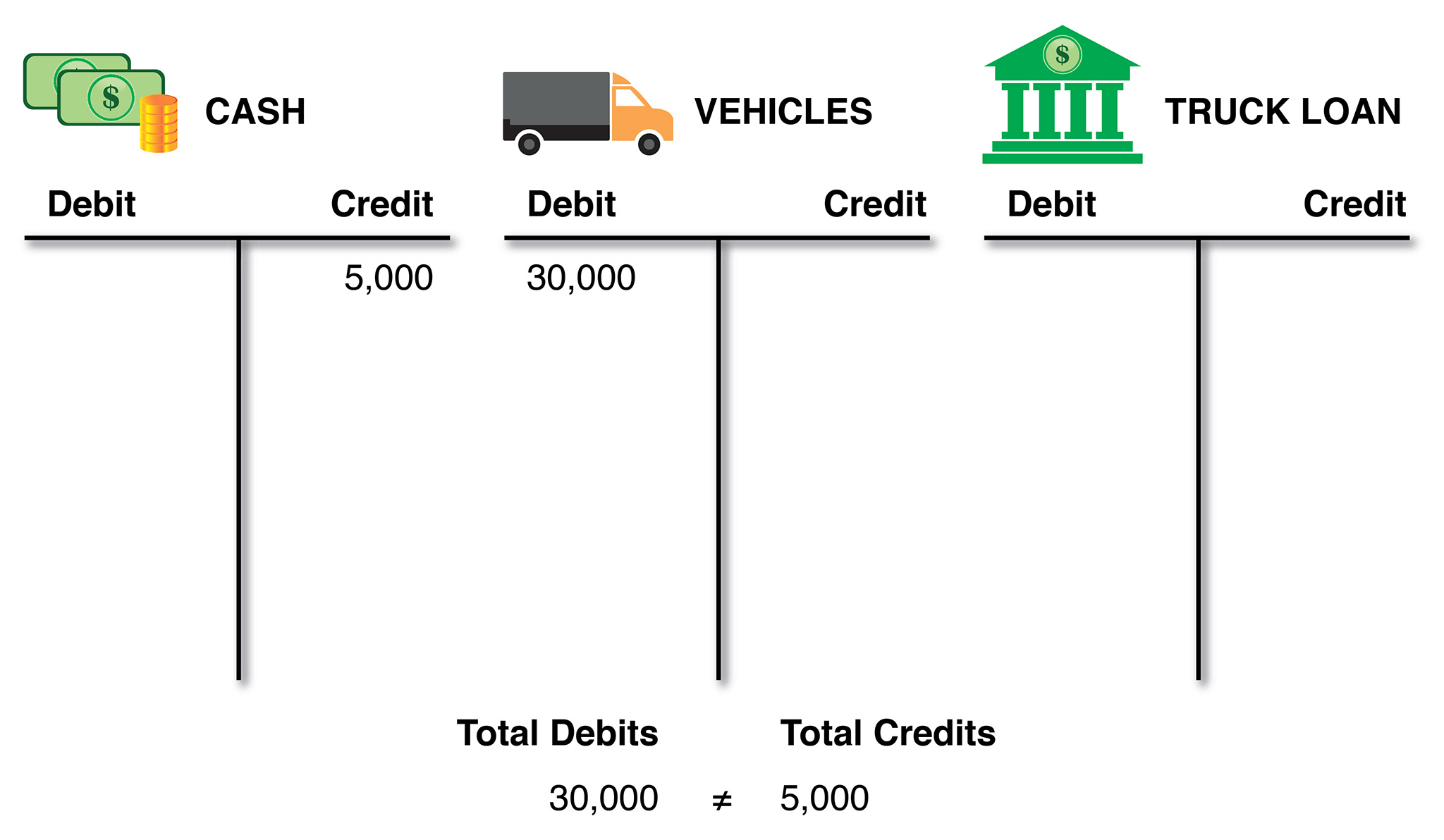

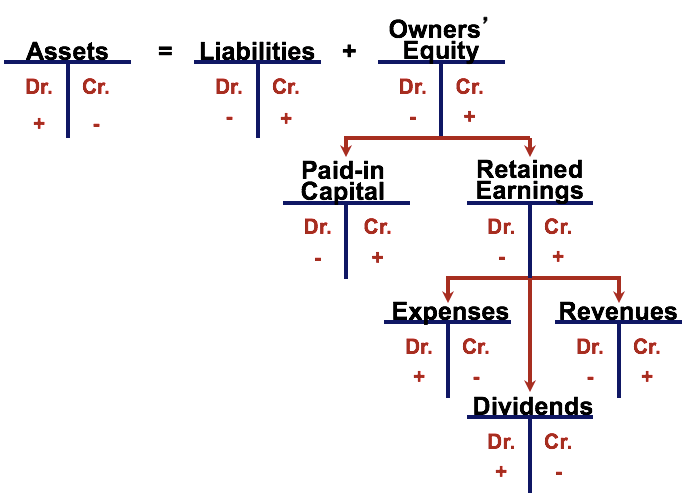

Guide to T-account Examples. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. For example, if a company issued equity shares for $500,000, the journal entry would be composed of a Debit to Cash and a Credit to Common Shares.

Video Explanation of T Accounts Below is a short video that will help explain how T Accounts are used to keep track of revenues and expenses on the income statement. Download free T account templates in Excel and PDF formats. Learn how to use T accounts for double.

T-accounts - Basics of Accounting & Information Processing

T Accounts are the best visual way to represent accounts. Let's do an example. A T-chart is a visual tool in accounting that simplifies understanding debits and credits, the core components of the double-entry bookkeeping system.

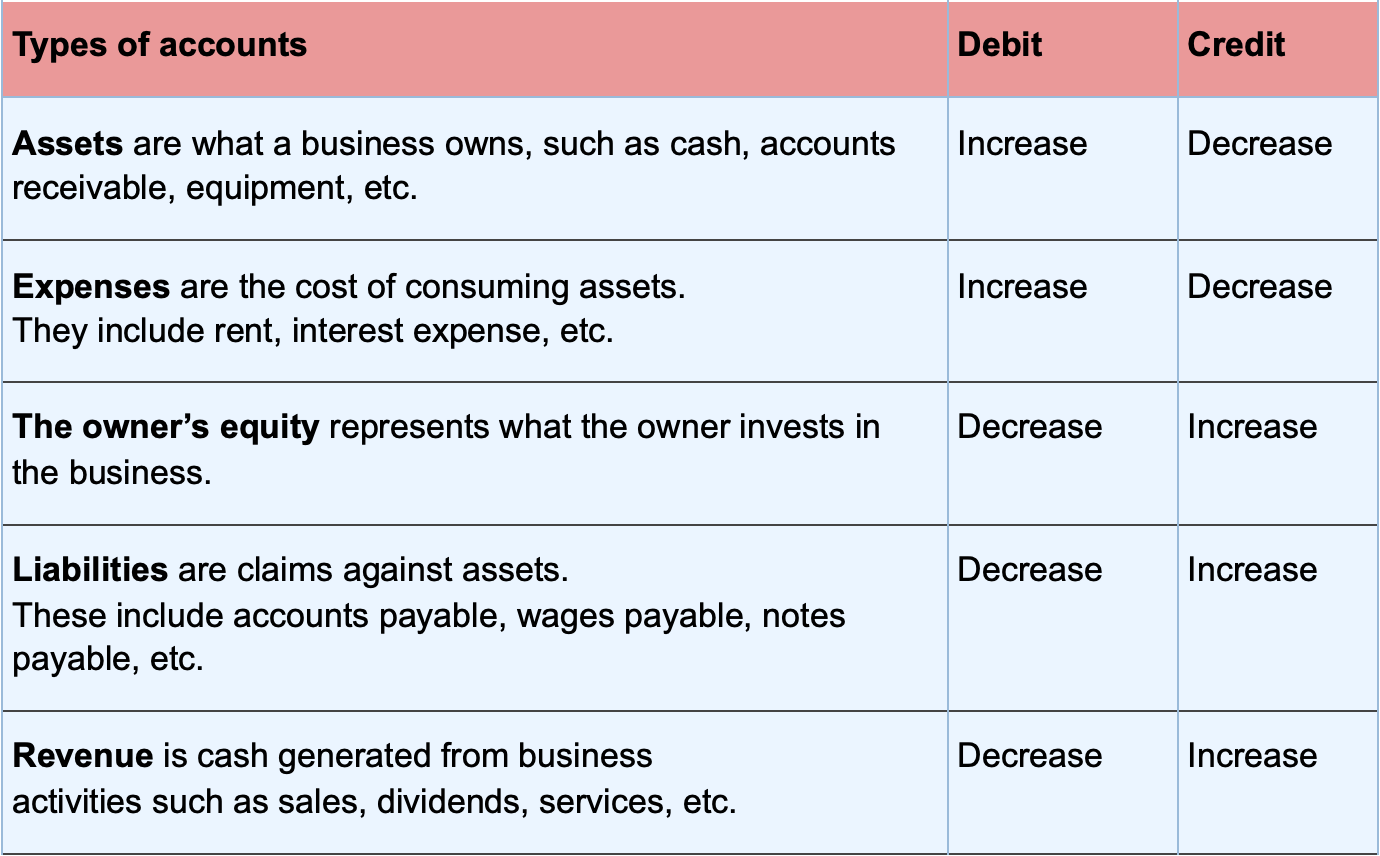

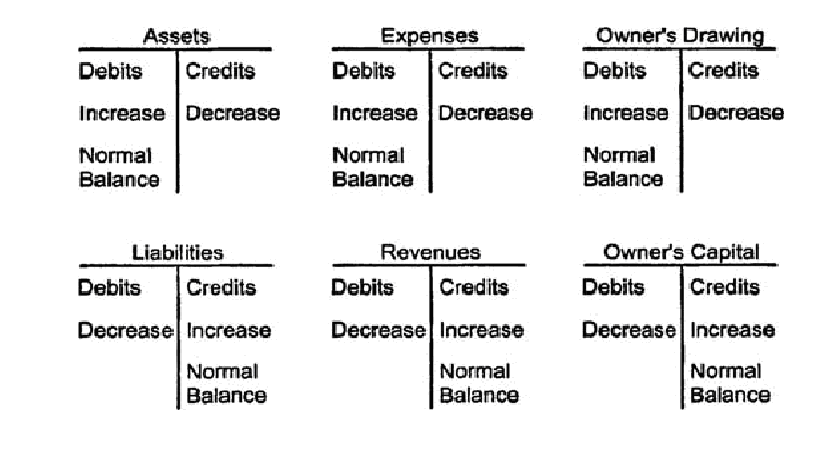

It helps analyze increases and decreases within an account, illustrating how financial transactions impact individual accounts in the general ledger. All the main T-accounts in a business fall under the general ledger. For example, land and buildings, equipment, machinery, vehicles, financial investments, bank accounts, inventory, owner's equity (capital), liabilities - the T-accounts for all of these can be found in the general ledger.

Accounting T Charts – emmamcintyrephotography.com

Subsidiary Ledgers (or Sub Ledgers). By following these guidelines carefully and avoiding common pitfalls, you'll enhance your understanding of financial management through effective use of T tables in accounting practices. Applications of T Tables in Accounting T tables serve multiple applications within accounting, enhancing clarity and efficiency in financial management.

Learn what T-accounts are in accounting with clear T-account examples, key benefits, and a simple guide to transaction recording. Discover clear accounting T accounts examples, including debits, credits, and their impact on your income statement.