W9 Ben Instructions

For additional information and instructions for the withholding agent, see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W. Understand the importance and procedures of W-8BEN and W-9 forms in the U.S. tax system.

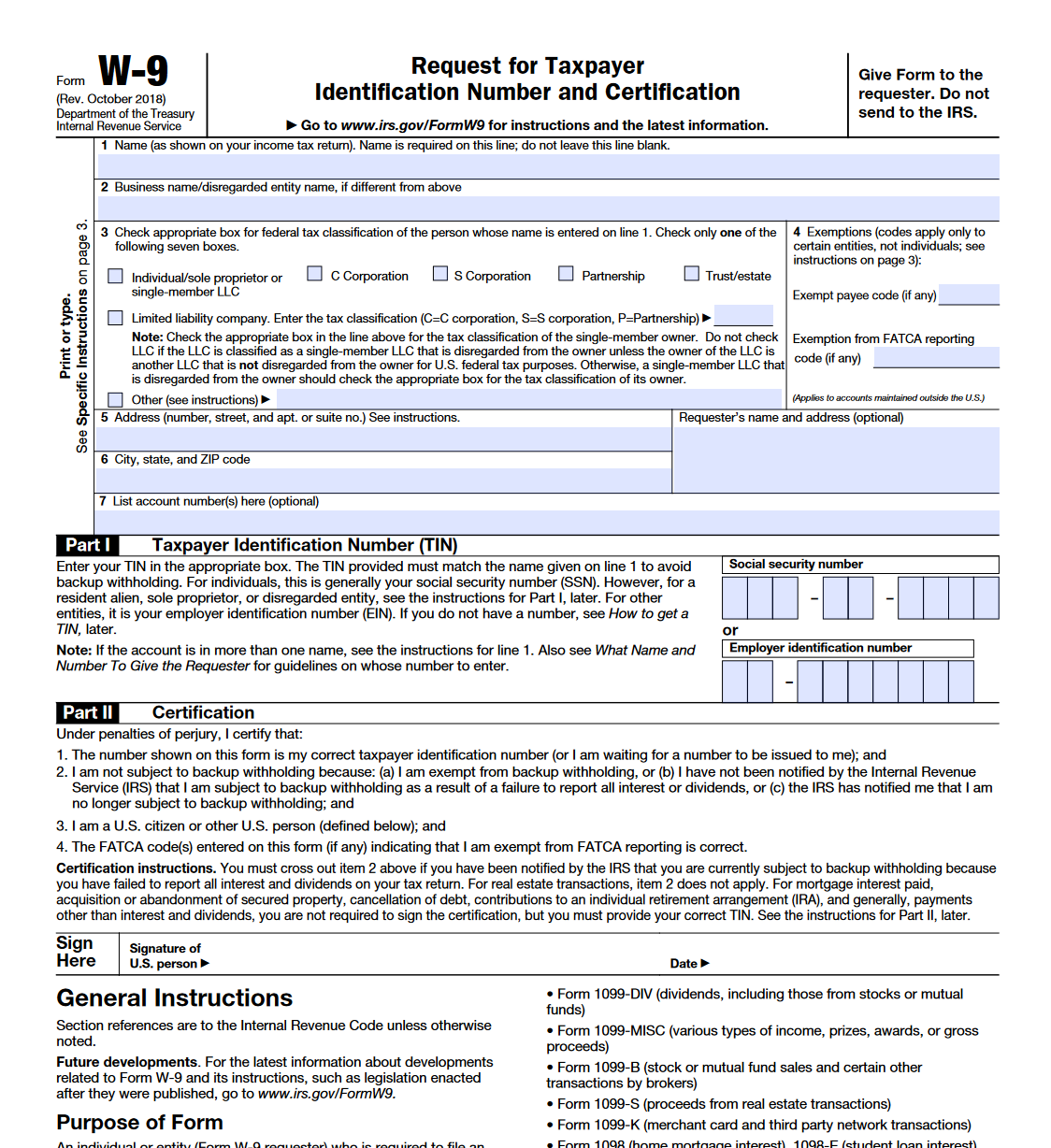

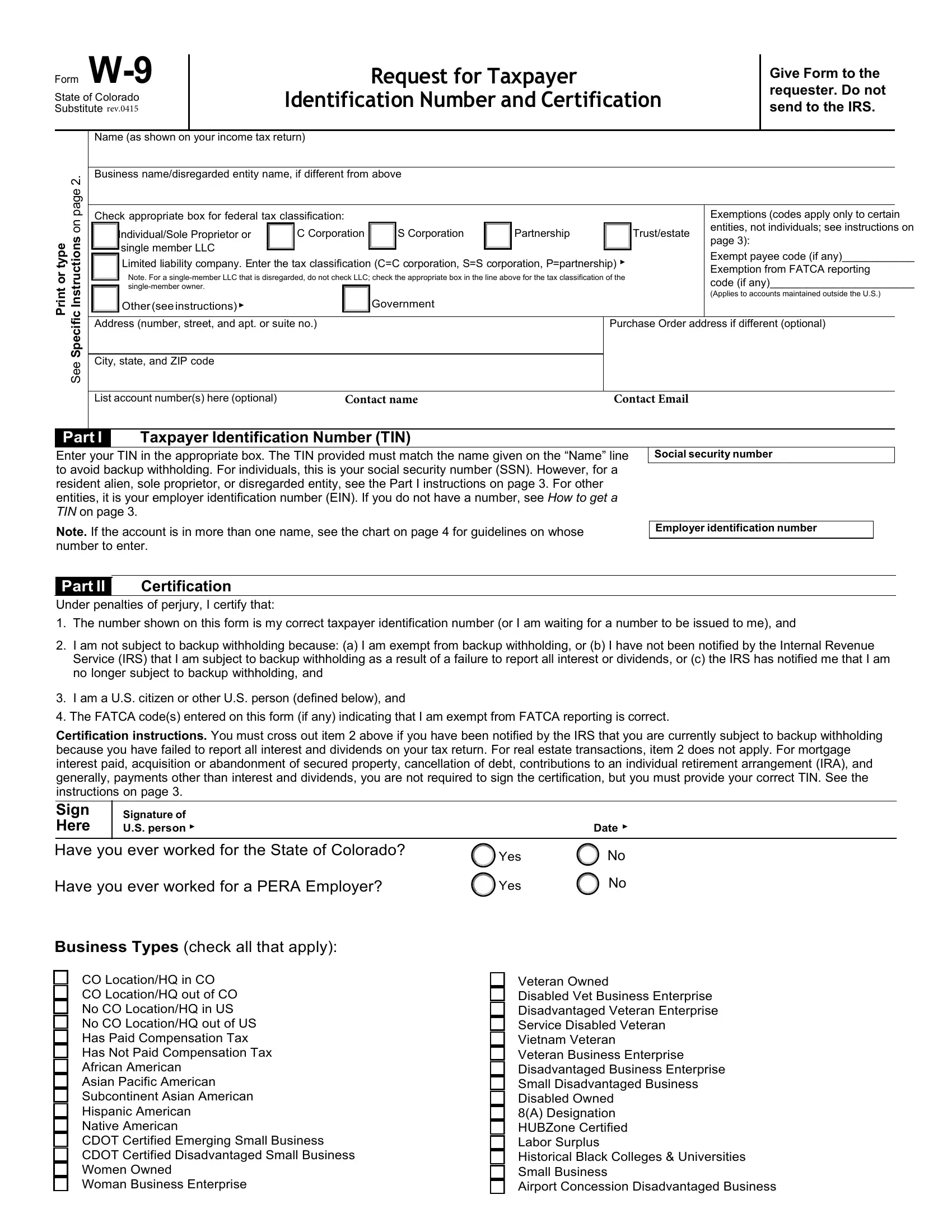

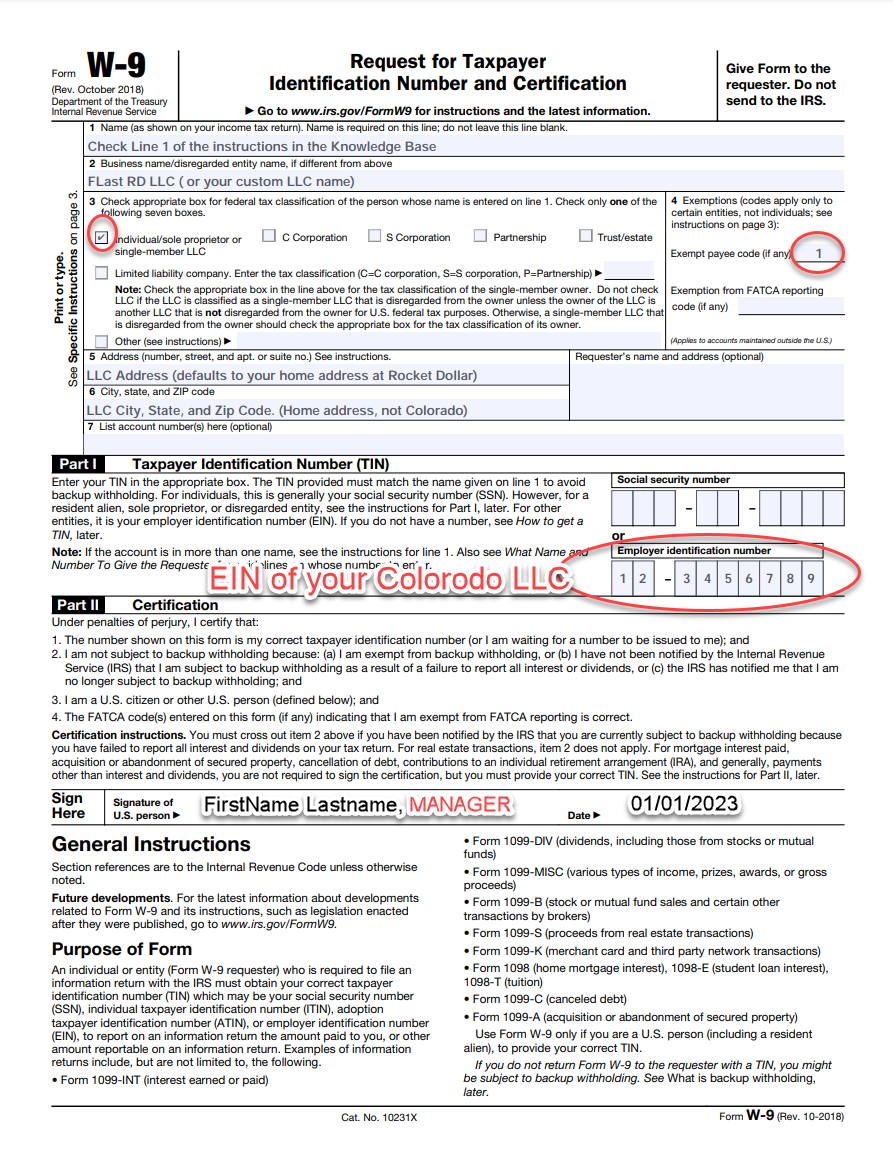

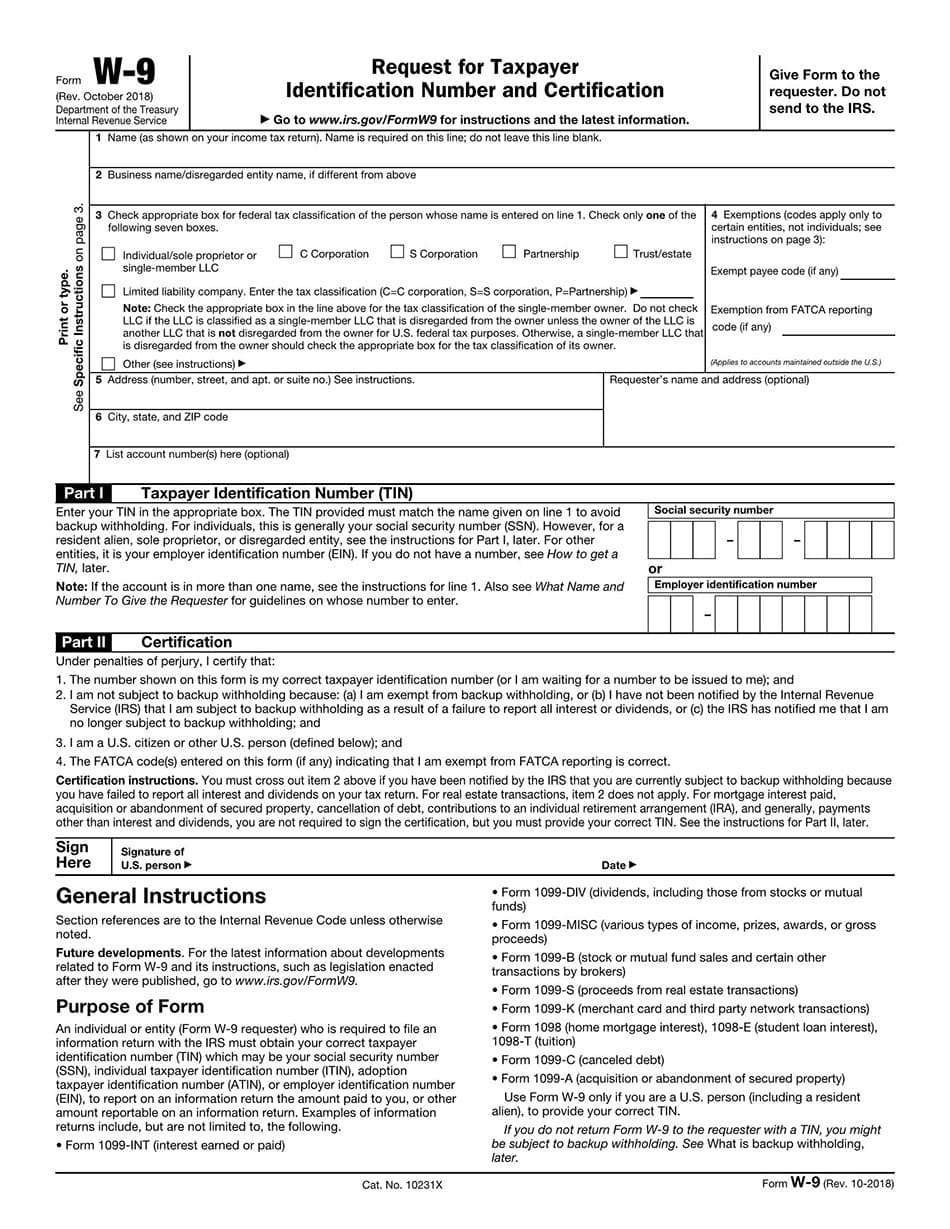

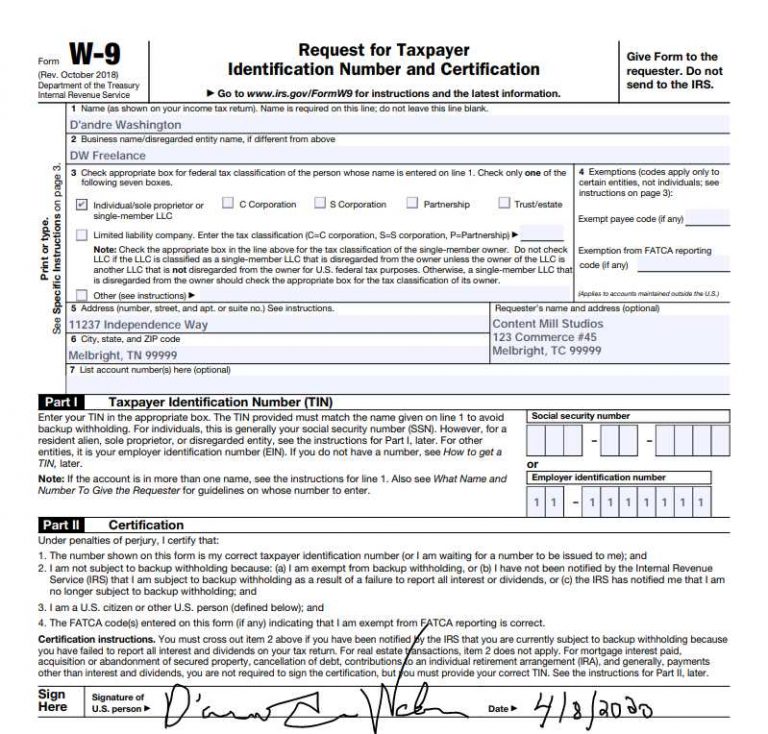

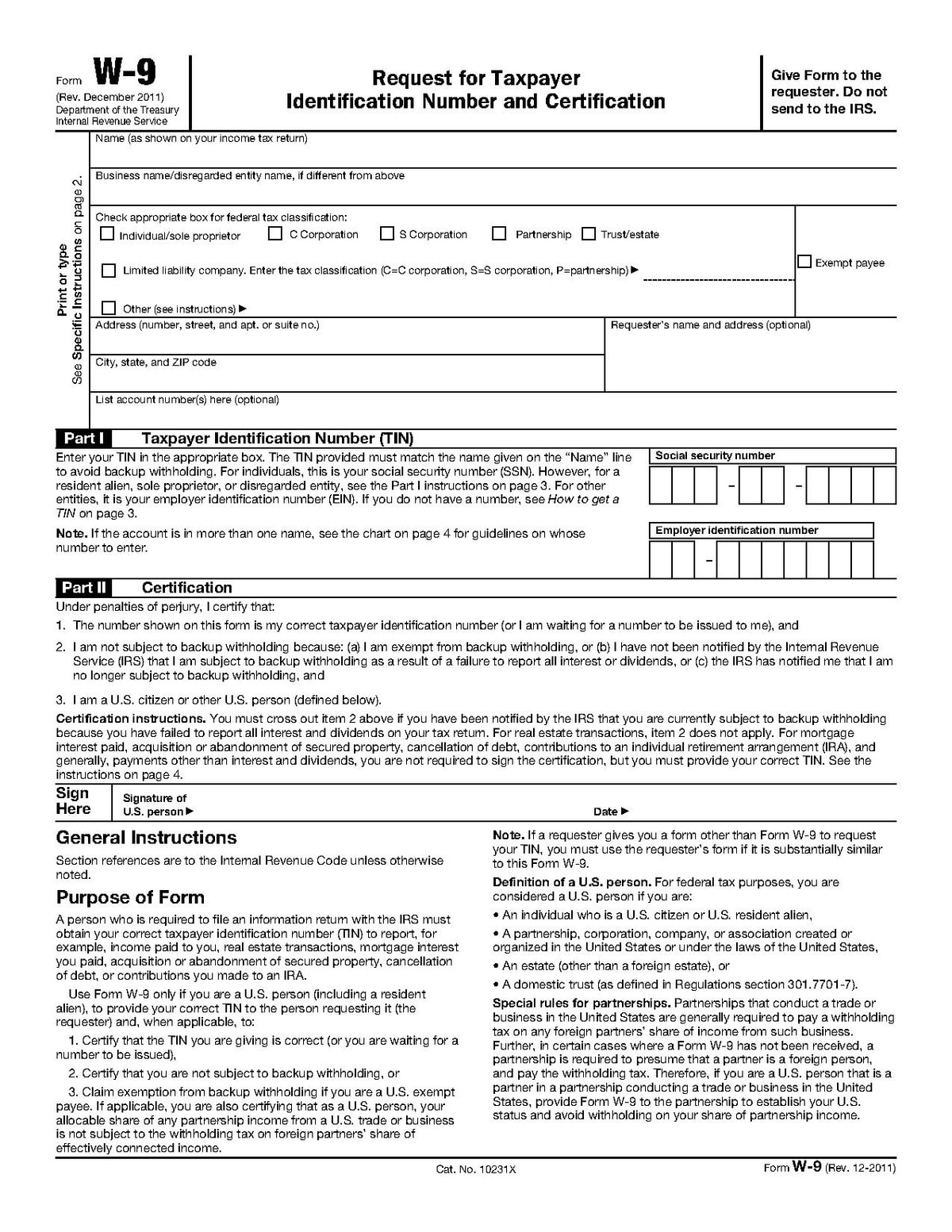

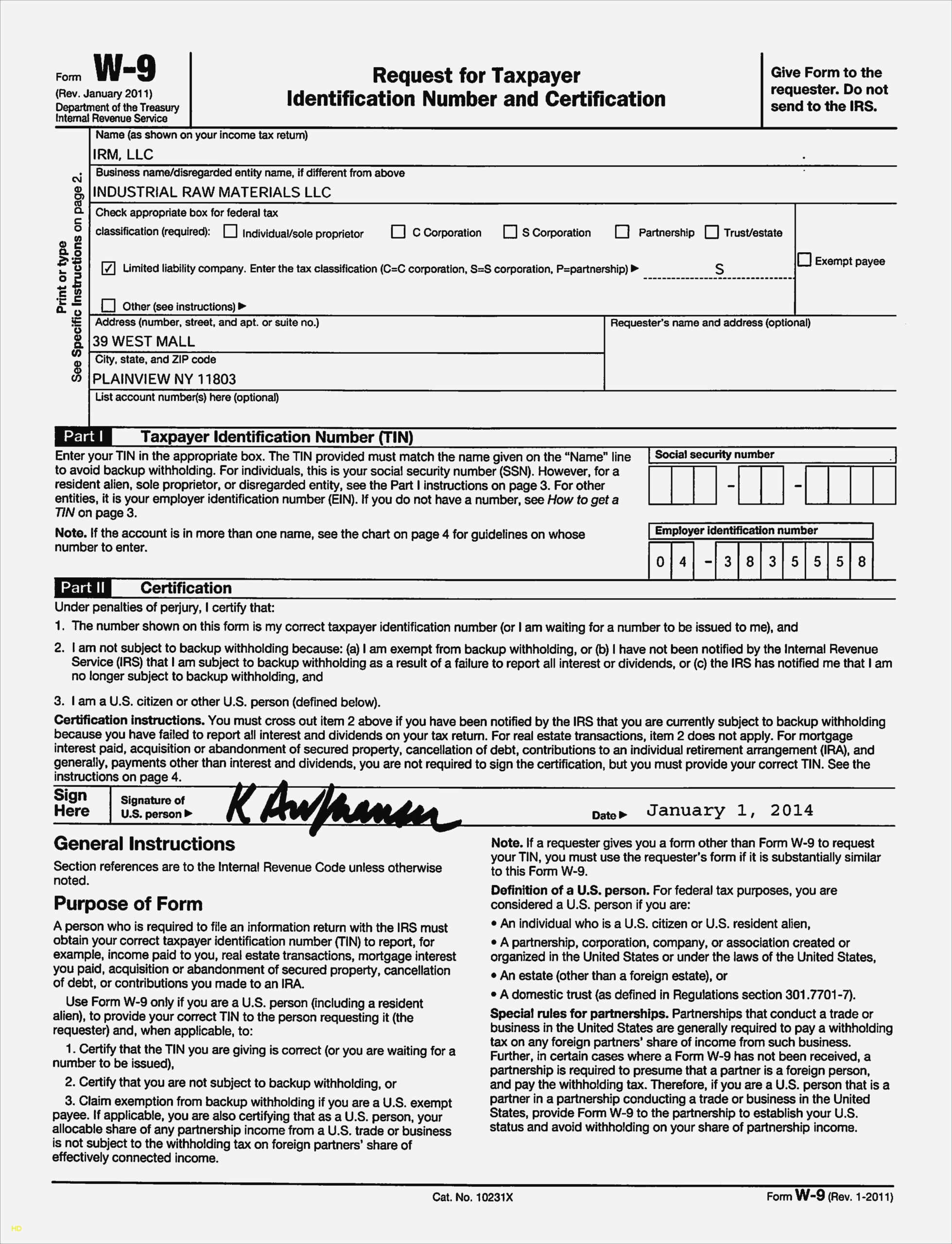

Learn who should fill out these forms, how to complete them accurately, and how Tam Accounting can assist you with tax compliance and advisory services. Information about Form W-9, Request for Taxpayer Identification Number (TIN) and Certification, including recent updates, related forms, and instructions on how to file. Form W-9 is used to provide a correct TIN to payers (or brokers) required to file information returns with IRS.

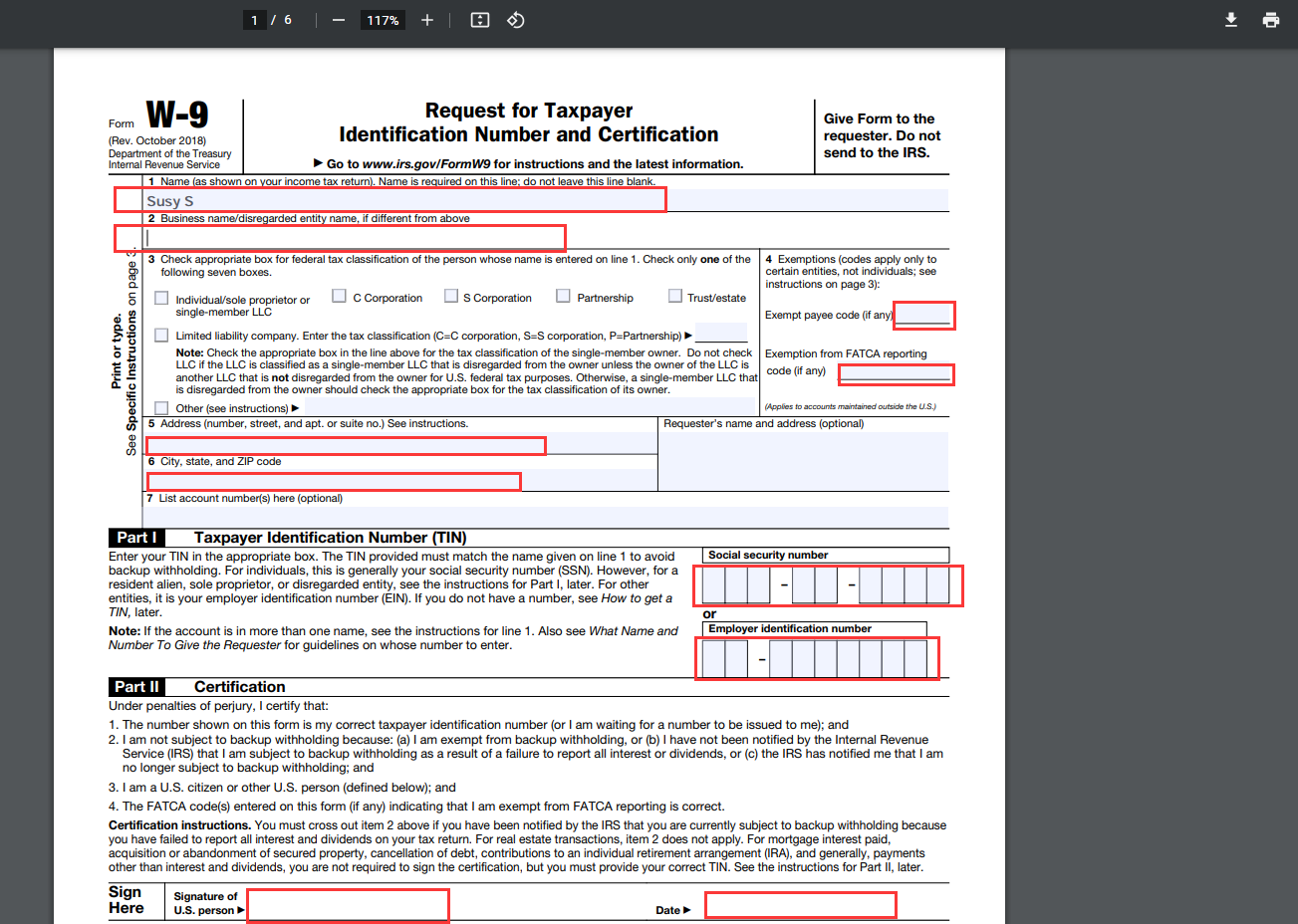

W9 2025 Fillable Free - Valeria Skye

Discover the key differences between Form W-9 and Form W-8 BEN, their purposes, and who should use them for tax compliance. Read our detailed comparison now! Instructions for US Citizens and US Resident Aliens Please complete, sign, and return the enclosed Form W-9, Request for Taxpayer Identification Number and Certification. Learn about the W-9, W-8 BEN, and W-8 BEN-E forms, their purposes, who should fill them out, and how to complete them correctly.

See the definition of Amounts subject to withholding, later. Additional information. For additional information and instructions for the withholding agent, see the Instructions for the Requester of Forms W-8BEN, W-8BEN-E, W-8ECI, W-8EXP, and W.

.png)

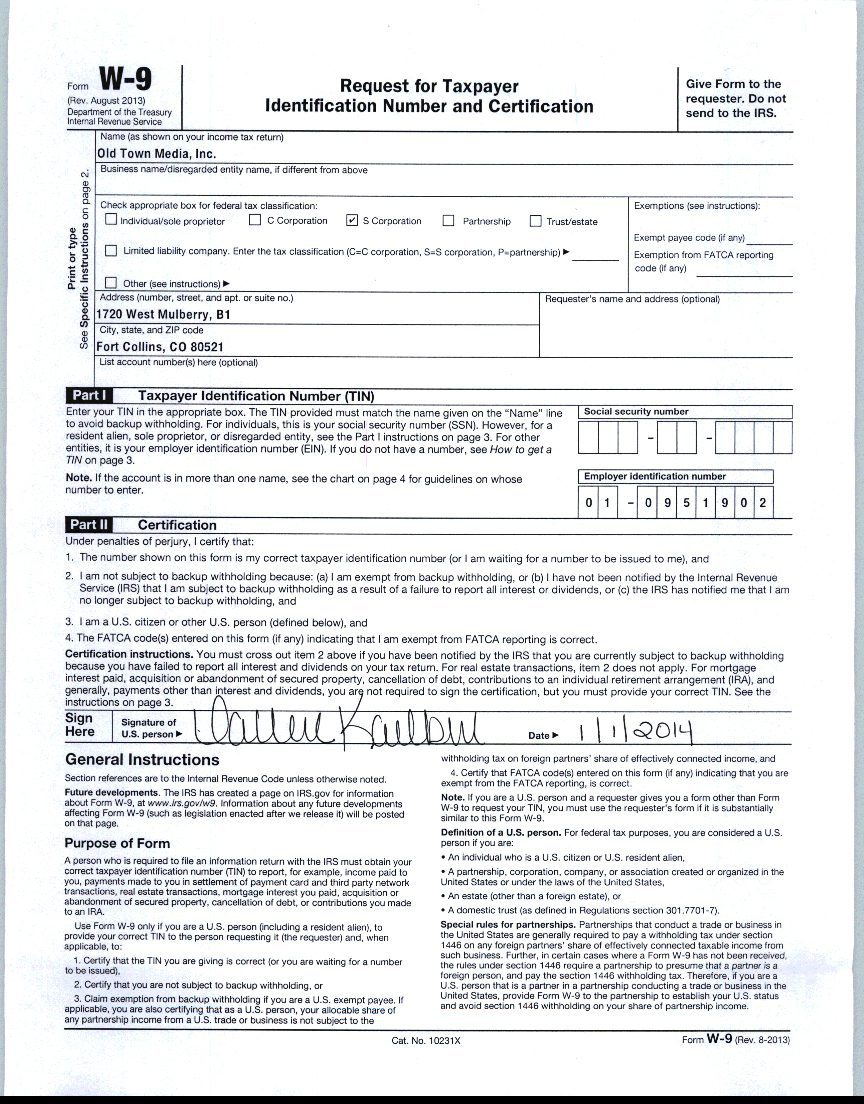

Company W9 Form 2025 - Apollo Quinnt

A W-8 BEN form is a United States Internal Revenue Service (IRS) tax form used to determine the foreign status of non-resident aliens for the purposes of taxation. Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report. You may use the W9 or W8 for you as an individual, or your company.

When you submit invoices, your name will appear and you also can enter your business name to display on invoices that we send to clients, but it is not required. At the end of the year, our accounting team sends you a 1099 (or equivalent) using the tax form on file. Information about Form W-8 BEN, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities), including recent updates, related forms and instructions on how to file.

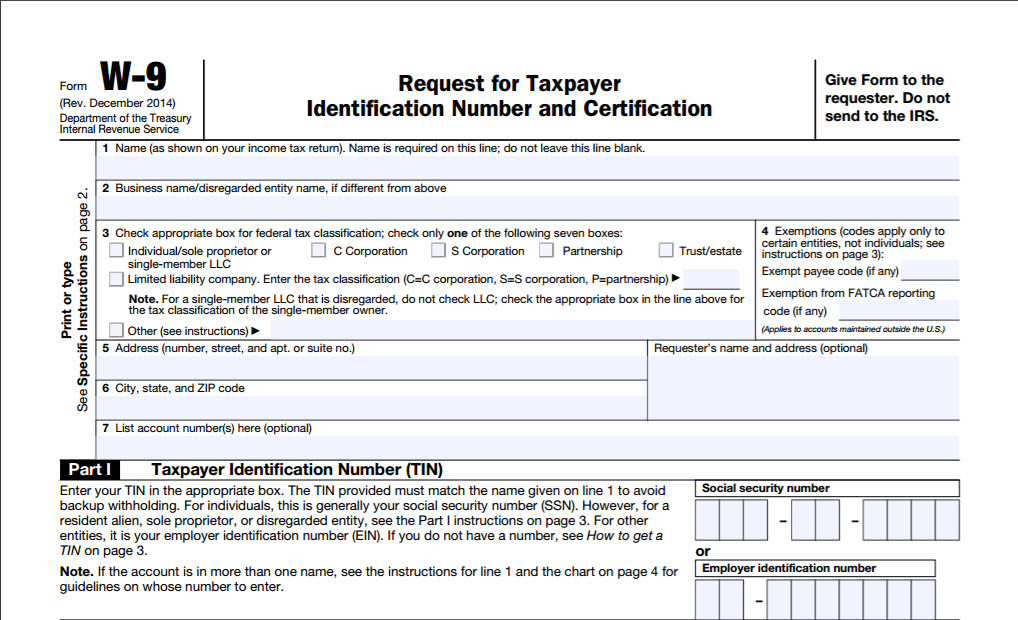

Form W9 2025 - Ella R. Jimenez

Submit Form W.