T Chart Accounting Example

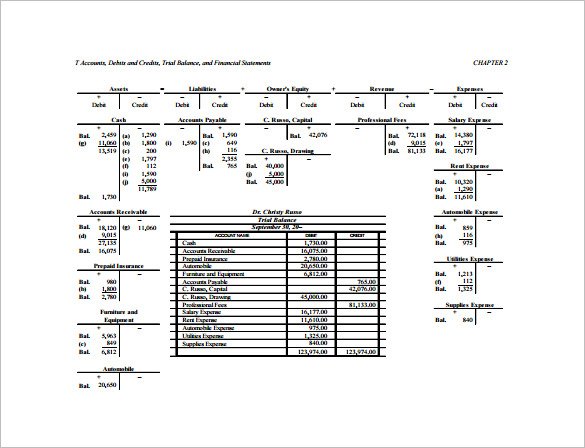

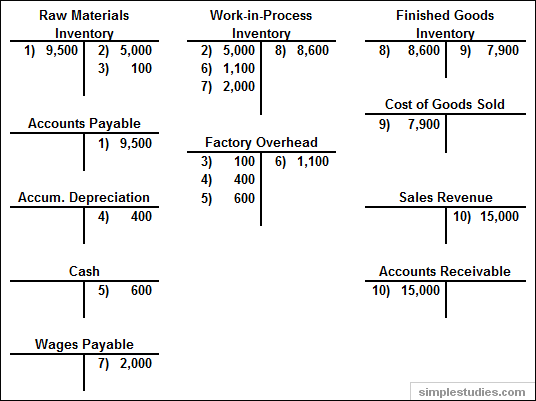

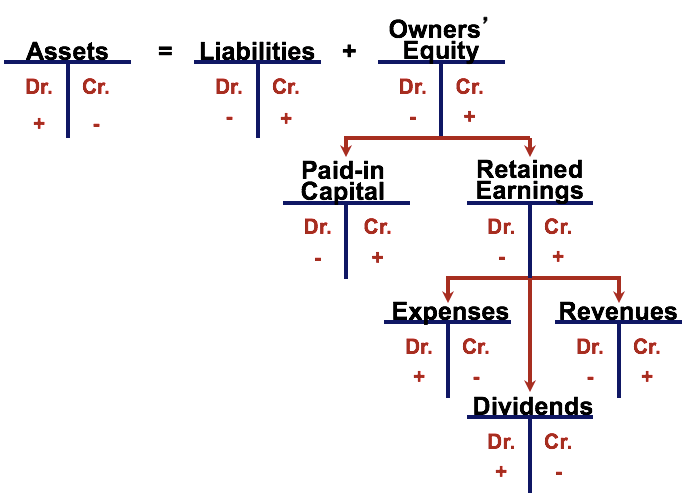

Guide to T-account Examples. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. For example, if a company issued equity shares for $500,000, the journal entry would be composed of a Debit to Cash and a Credit to Common Shares.

Video Explanation of T Accounts Below is a short video that will help explain how T Accounts are used to keep track of revenues and expenses on the income statement. Download free T account templates in Excel and PDF formats. Learn how to use T accounts for double.

T Accounts - A Guide to Understanding T Accounts with Examples

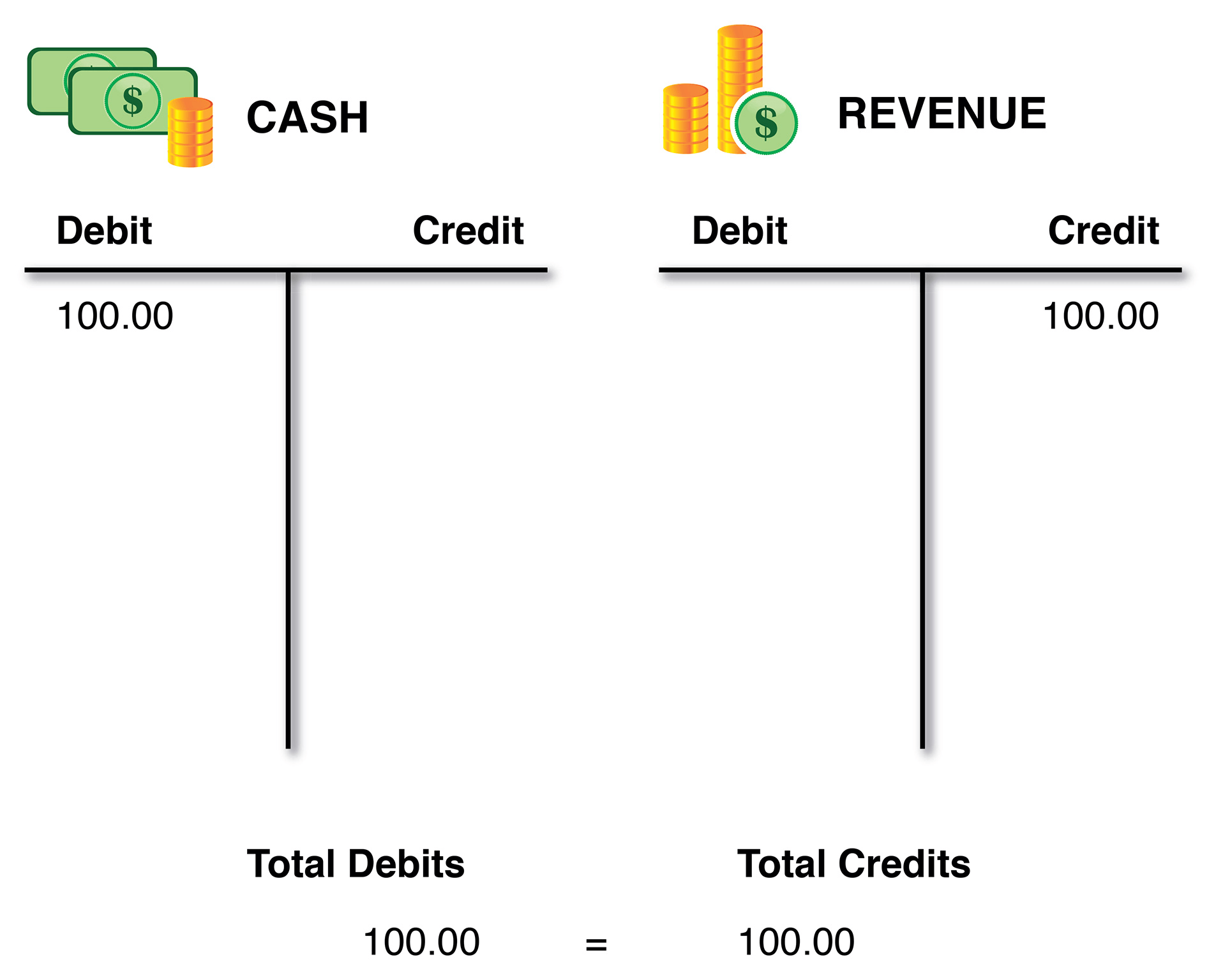

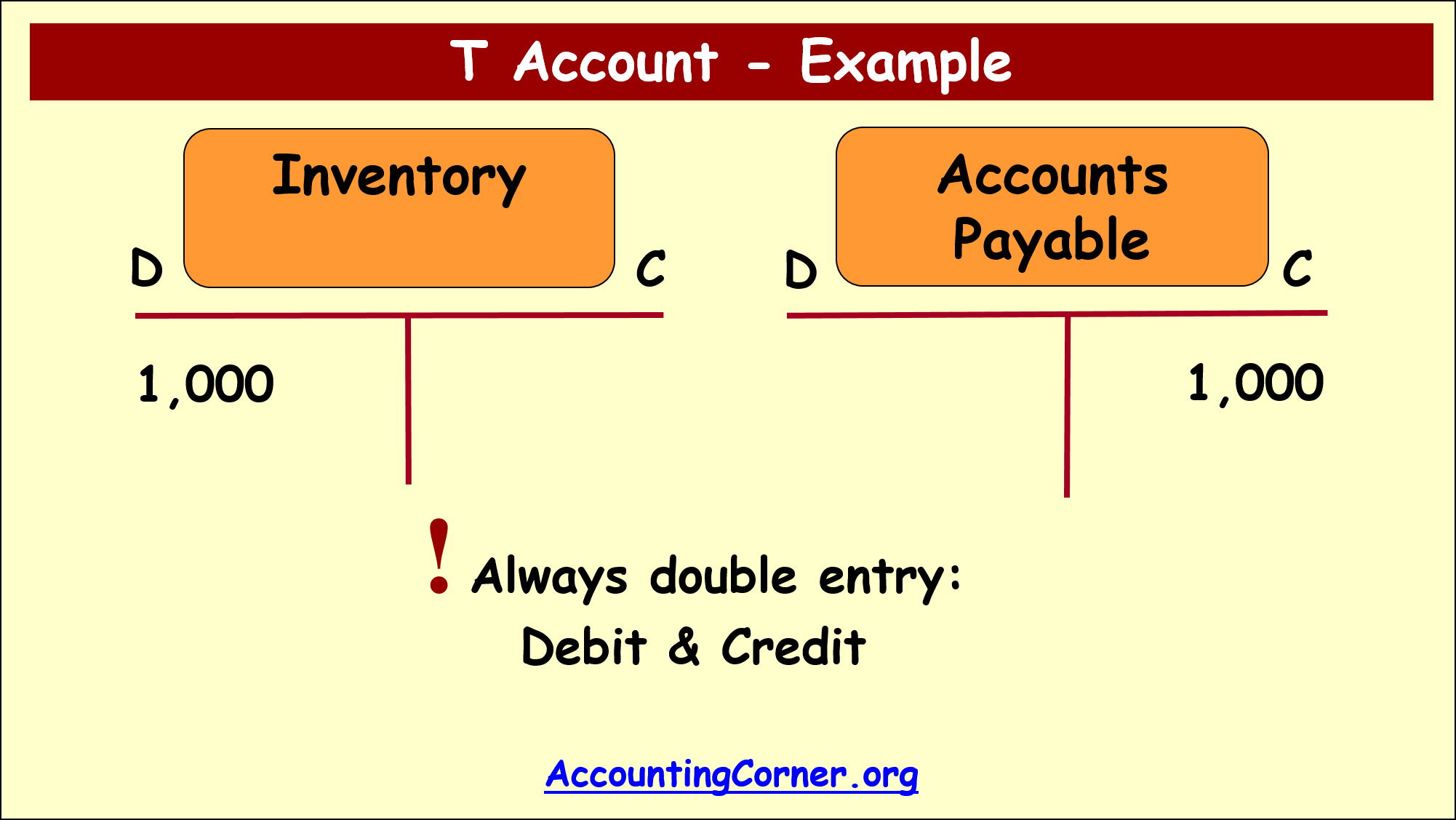

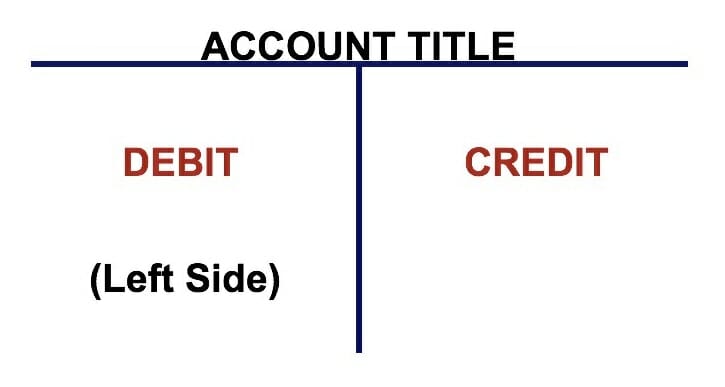

A T-chart is a visual tool in accounting that simplifies understanding debits and credits, the core components of the double-entry bookkeeping system. It helps analyze increases and decreases within an account, illustrating how financial transactions impact individual accounts in the general ledger. A T-account is a running record of debits and credits, listed on opposing sides of a vertical line as is required by the double.

T Accounts are the best visual way to represent accounts. Let's do an example. Understand T-accounts in accounting.

T Accounts - A Guide to Understanding T Accounts with Examples

Learn how they work, how to use them to record transactions, and how they help in the accounting process. Discover how T accounts simplify tracking financial transactions, enhancing understanding of debits and credits for better financial literacy and management. Find out what an Accounting T Chart is.

View the definition, similar terms, common misconceptions, and practical use cases in accounting.