Intuit Latest Payroll Update

This tax table includes new withholding tables for: Maryland. This tax table includes other changes for: Michigan, New Mexico, and West Virginia. to see a cumulative list of all tax table updates for 2025 and required actions.

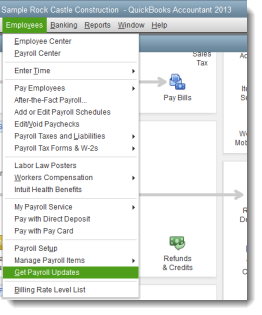

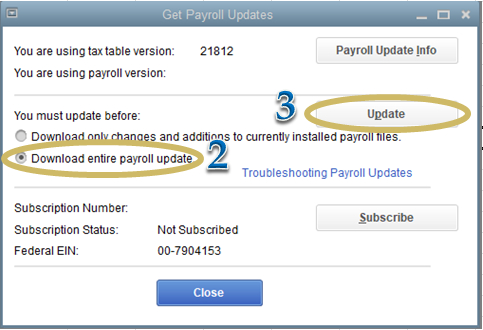

to see the latest payroll news and updates. Learn how to get the newest tax table in QuickBooks Payroll to stay compliant with paycheck calculations. The payroll tax tables provide up-to-date, accurate rates and calculations for federal and supported state taxes, payroll tax forms, and e.

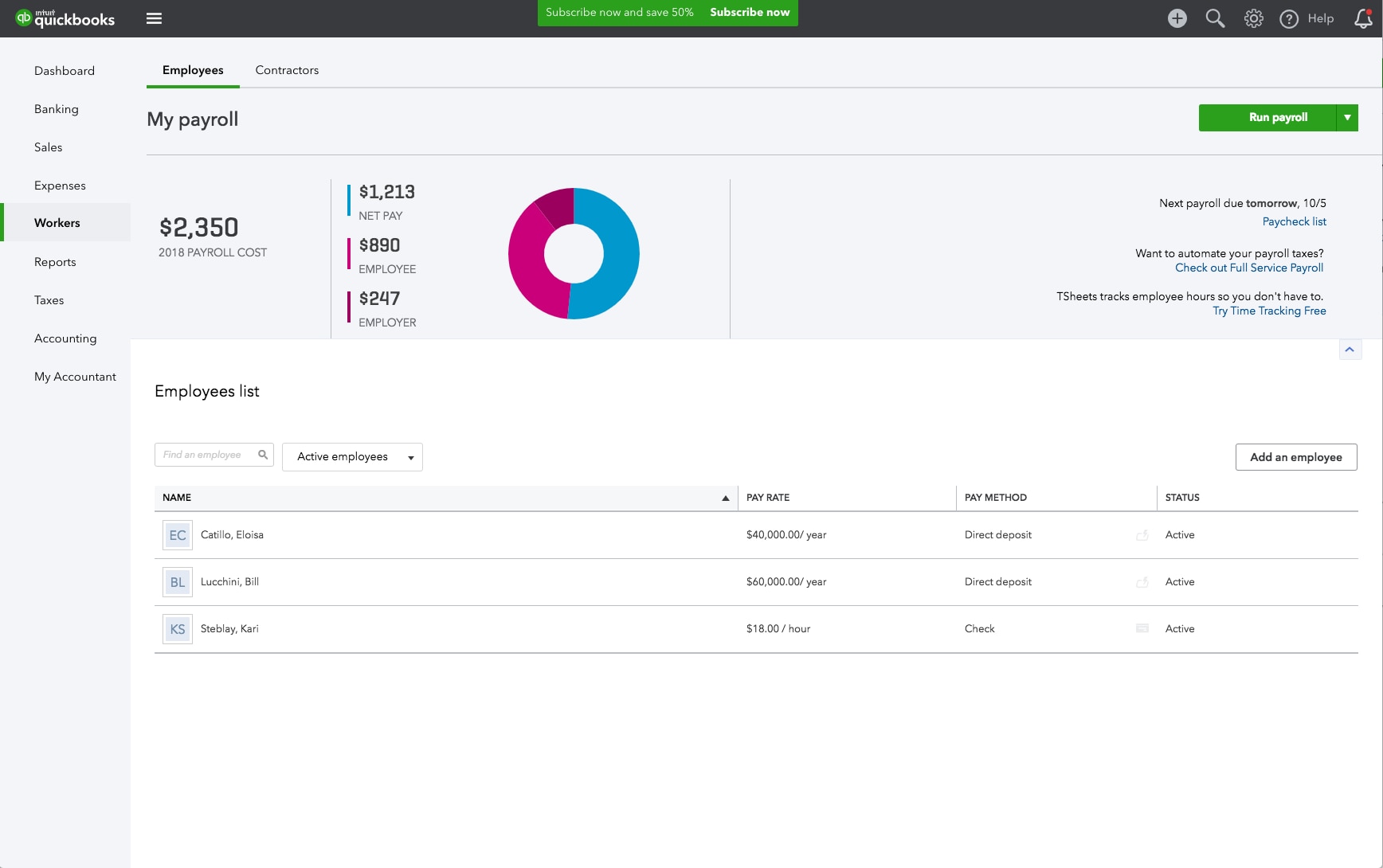

Payroll for Accountants, QuickBooks Payroll Solutions | Intuit

Intuit has rolled out pricing changes for Payroll effective August-December of 2025. The table below outlines changes and dates per QuickBooks version. If you have [].

Payroll Update 22412 for QuickBooks 2024 Summary of Tax Table Updates This tax table includes new withholding tables for: Idaho. This tax table includes revised withholding tables for: Georgia and Ohio. to see a cumulative list of all tax table updates for 2024 and required actions.

Intuit View My Paycheck

to see the latest payroll news and. The latest Payroll Update we have is 22401, which was released on December 14, 2023. To about this one, check out this article:Get the latest payroll news and updates in QuickBooks Desktop Payroll.

Payroll Update 22416 for QuickBooks 2024 Summary of Tax Table Updates This tax table includes new withholding tables for: Kansas. This tax table includes revised withholding tables for: Arkansas. This tax table includes other changes for: District of Columbia and Delaware.

reactivating/renewing my payroll subscription

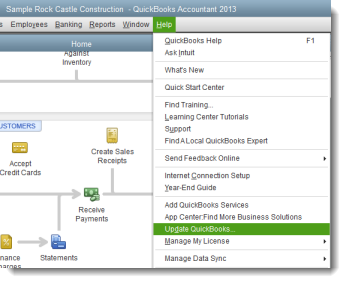

In case you're referring to Intuit releasing a newer version of the program, you can check this page for updates: What's new in QuickBooks Desktop 2024. On the other hand, here's an article to help you keep your tax table updated: Download the latest payroll tax table update for QuickBooks Desktop. I have the most recent update, 22501 released December 19, which lists Washington tax rate changes for 2025, but those rates are not reflected in the payroll items list.

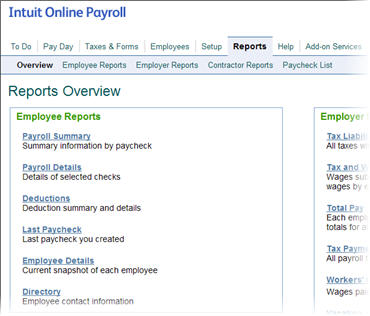

Since your QBDT Payroll subscription ends on December 15, 2024, you will lose access to your Form 940 and W-2 for printing. Moreover, printing and e. Summary of Tax Forms Updates For Enhanced Payroll for Accountants payroll subscribers, this Payroll Update contains a federal forms that was updated: Form 940 for Reporting Agents.

For Standard and Enhanced payroll subscribers, this Payroll Update contains federal forms that were updated: Form 940 and Form 943.