Examples Of T Accounts

Guide to T-account Examples. Here we discuss top examples, including rent expense, accounts payable, salary expense, office expense, etc. Learn what a T-account is, how to use it, and how to post journal entries to it.

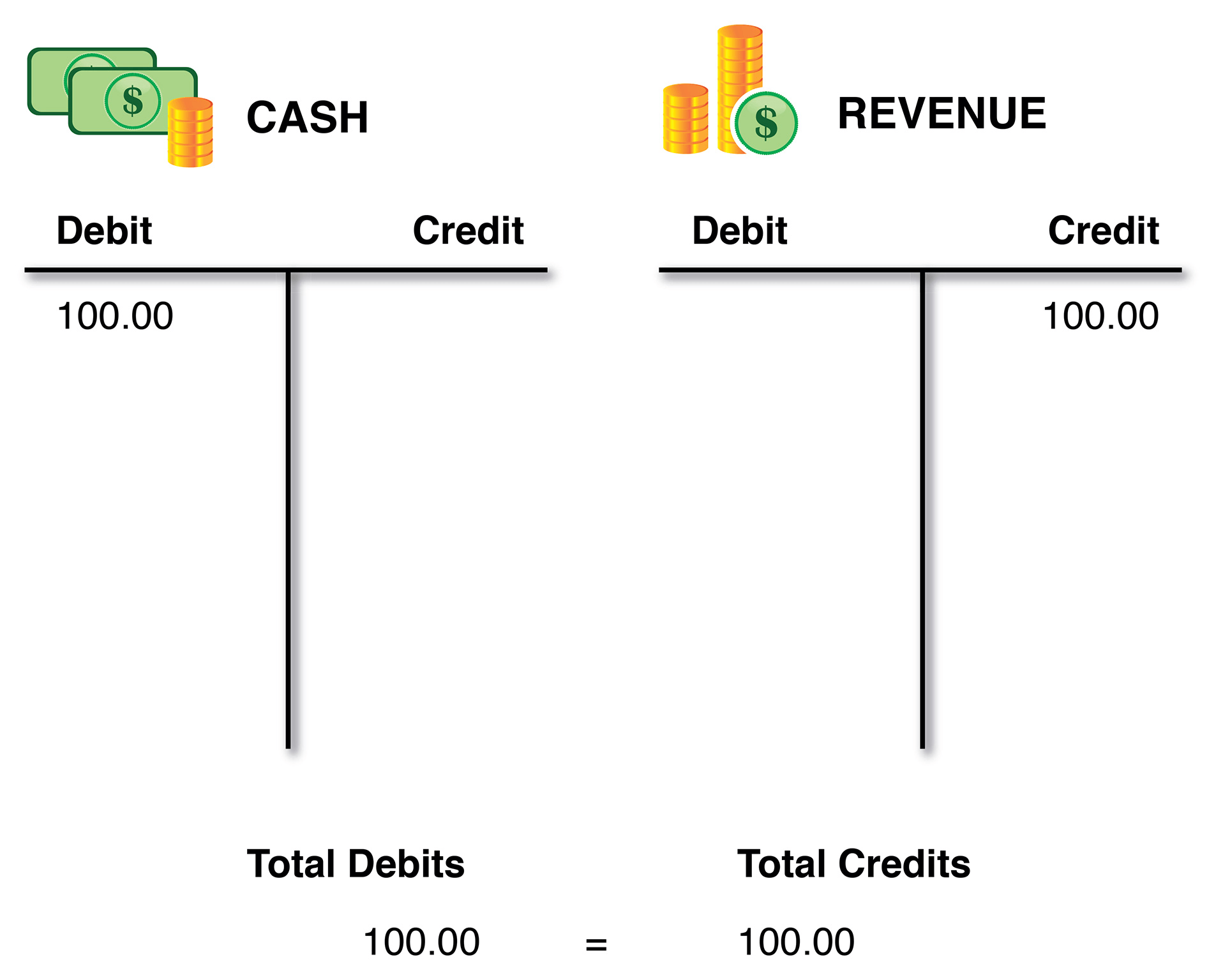

See examples of T. A T-account is a running record of debits and credits, listed on opposing sides of a vertical line as is required by the double. Learn what T-accounts are in accounting with clear T-account examples, key benefits, and a simple guide to transaction recording.

T Account Template

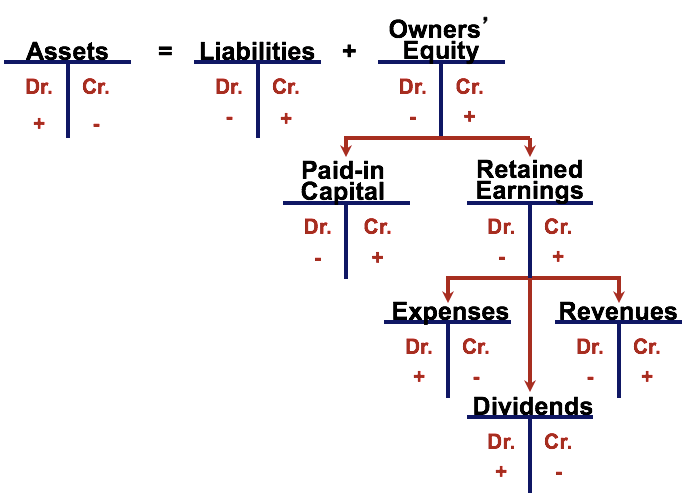

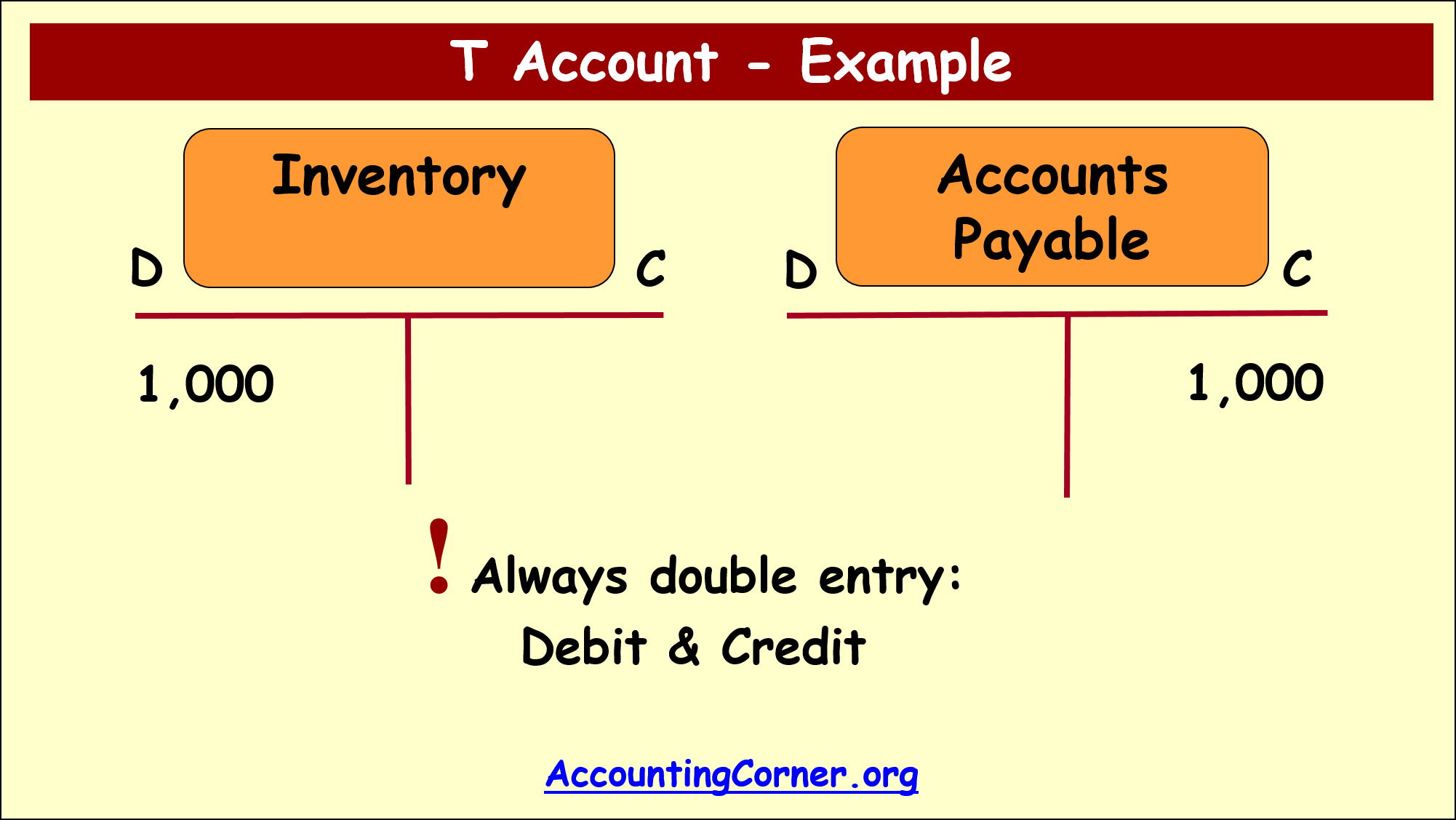

What are T Accounts? If you want a career in accounting, T Accounts may be your new best friend. The T Account is a visual representation of individual accounts in the form of a "T," making it so that all additions and subtractions (debits and credits) to the account can be easily tracked and represented visually. A T-account is a tool used in accounting to visually represent changes in individual account balances.

Each t-account has two columns, one for debits and the other for credits. Discover how T accounts simplify tracking financial transactions, enhancing understanding of debits and credits for better financial literacy and management. For example, land and buildings, equipment, machinery, vehicles, financial investments, bank accounts, inventory, owner's equity (capital), liabilities.

T Account Template

Discover clear accounting T accounts examples, including debits, credits, and their impact on your income statement. What are some common examples of T accounts? Common examples of T accounts include Cash, Accounts Receivable, Accounts Payable, Inventory, Prepaid Expenses, Accrued Expenses, Owner's Equity, Revenue, Cost of Goods Sold, and Utilities Expense.

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

:max_bytes(150000):strip_icc()/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)