Accounting T Chart

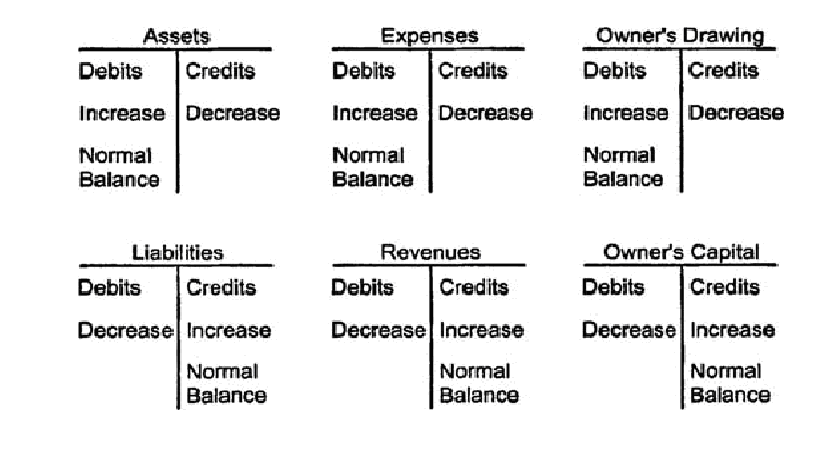

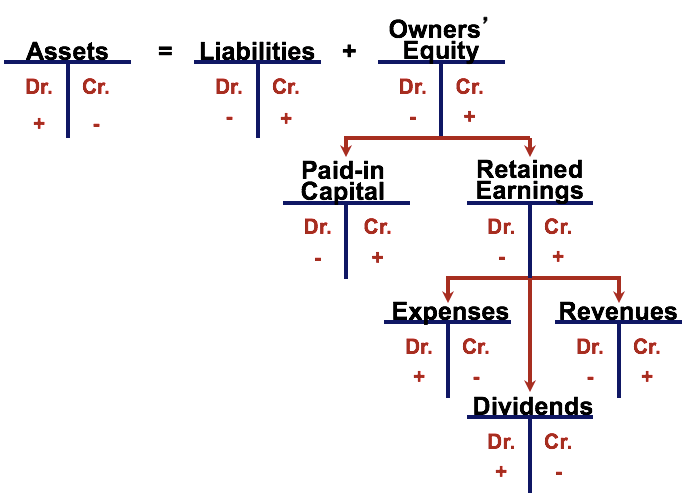

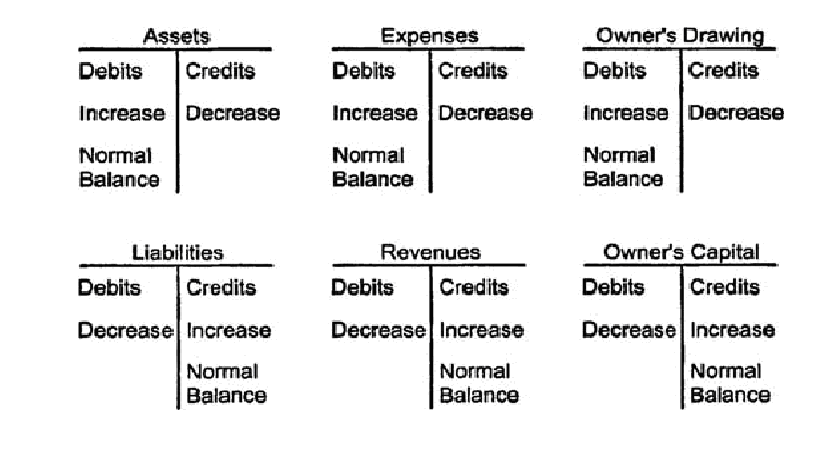

T Accounts are also used for income statement accounts as well, which include revenues, expenses, gains, and losses. Once again, debits to revenue/gain decrease the account while credits increase the account. Learn what a T-account is and how to use it to record journal entries and track account balances.

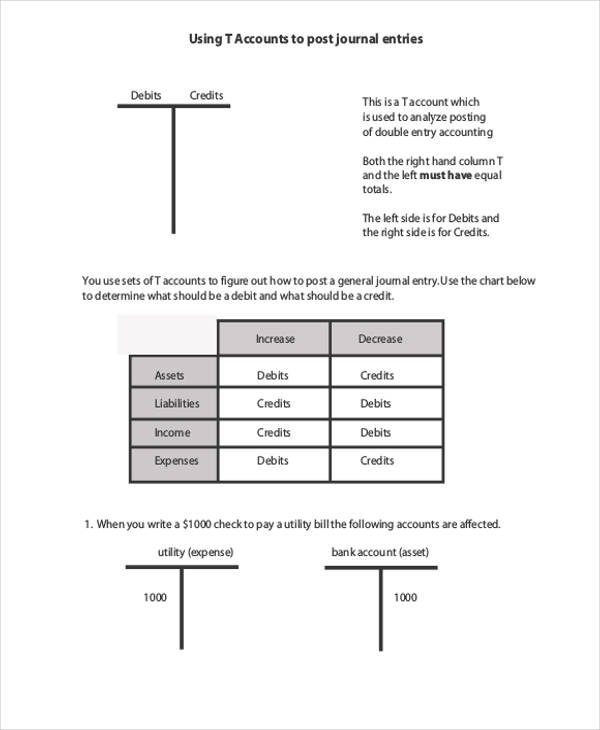

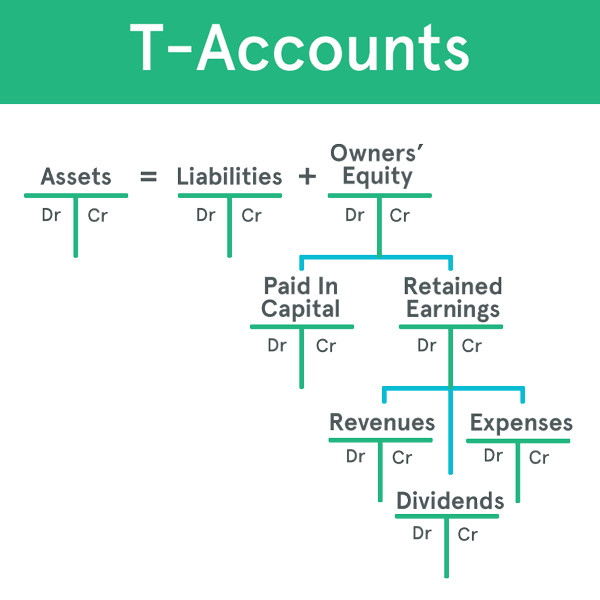

See how T-accounts are structured, posted, and balanced in the accounting cycle. A T-chart is a visual tool in accounting that simplifies understanding debits and credits, the core components of the double-entry bookkeeping system. It helps analyze increases and decreases within an account, illustrating how financial transactions impact individual accounts in the general ledger.

T-accounts - Basics of Accounting & Information Processing

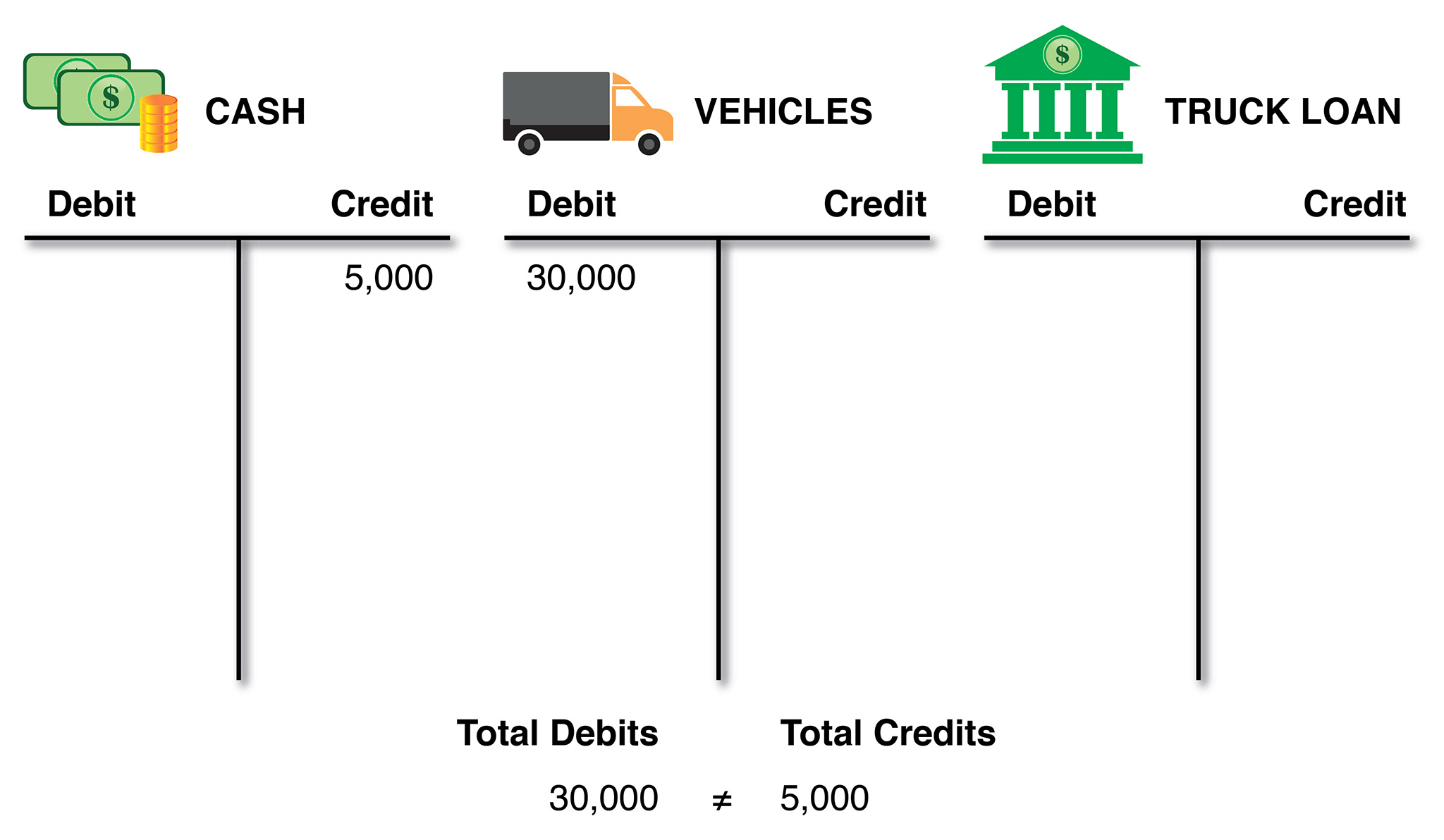

T Account is a visual presentation of accounting journal entries that are recorded by the company in its general ledger account in such a way that it resembles the shape of the alphabet 'T' and depicts credit balances graphically on the right side of the account and debit balances on the left side of the account. A T account ledger is an informal way of addressing a double. A T-account is a running record of debits and credits, listed on opposing sides of a vertical line as is required by the double.

Download free T account templates in Excel and PDF formats. Learn how to use T accounts for double. Learn what an Accounting T Chart is, how it represents the debits and credits of an account in the general ledger, and how it is used in double-entry bookkeeping.

T Accounts in Bookkeeping | Double Entry Bookkeeping

Find out the similar and different terms, the common misconceptions, and the practical scenarios of T Charts in accounting. T Accounts are the visual structure used in double entry bookkeeping to separate debits and credits. Learn what a T Account is, how it works, and what challenges it poses for accountants.

T-accounts help track changes in various types of accounts, including assets, liabilities, equity, revenues, and expenses. T-accounts provide a clear and concise way to analyze and understand the impact of transactions on a company's financial position and performance. T accounts are used by accountants to show the debits and credits visually in an account.

Accounting T Charts – emmamcintyrephotography.com

An account is where all the transactions for one specific area are rolled up into like the Cash account All the transactions are shown on a general ledger. The general ledger is the record of all transactions for a business.