Quickbooks Online Payroll Holiday Schedule

Currently, the Holiday Payroll Processing Calendar or receiving notice about the holidays is unavailable in QuickBooks. In the meantime, you can view the following articles below to get the list of federal holidays as your guide in managing your payroll schedule. QuickBooks Online makes it pretty straightforward to add holiday pay to your payroll, but there are a few key steps to follow so everything runs smoothly.

Plus, getting it right means no last. Hi info. You can add a Holiday pay type for any individual employee.

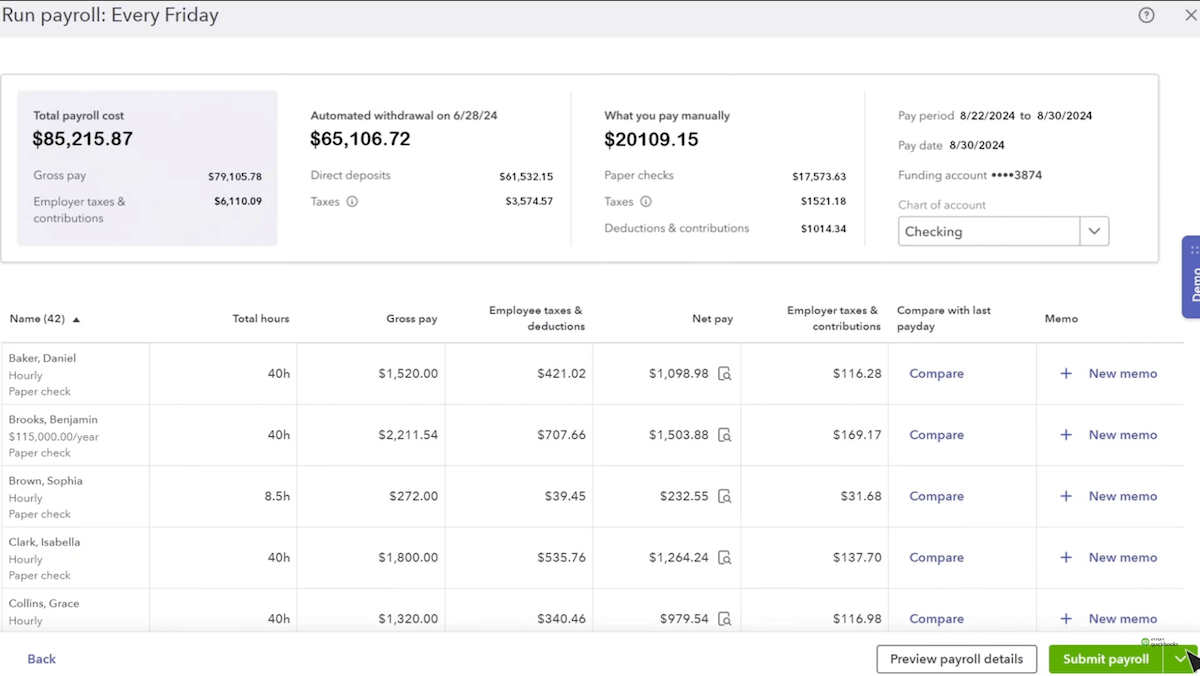

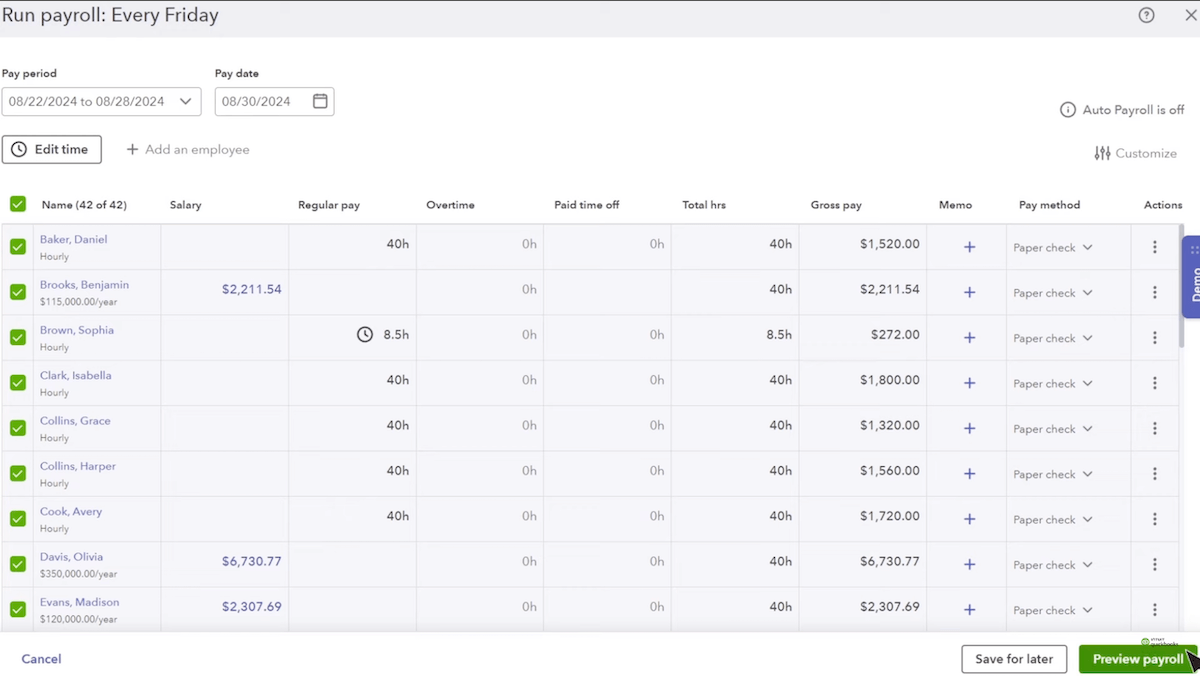

How To Process Payroll in QuickBooks: Easy Steps — Method

We'll need to go through each employee's profile for QuickBooks Online Payroll and Variable Input for PaySuite payroll. Because holiday hours are not considered hours worked, they are not included in the basis for accrual of vacation or sick leave. In states that have a workers' compensation tax based on hours worked, holiday.

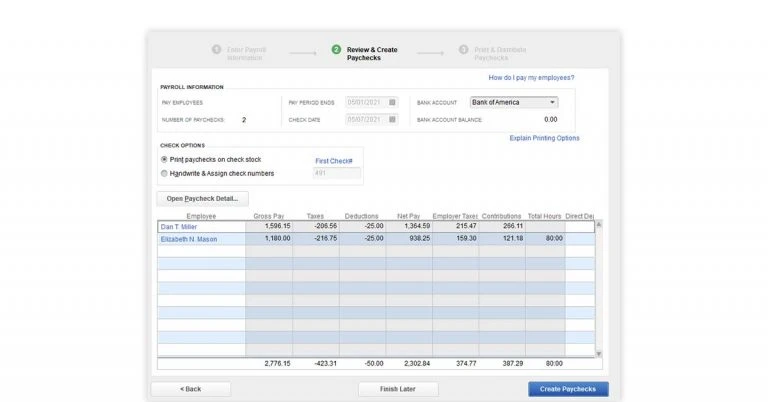

To add holiday pay to the payday page for an employee: In the left navigation bar, click Employees. Click the employee's name, and then click Edit employee. Under How much do you pay this employee? click Add additional pay types if you haven't selected any other pay types, or click the pencil icon if you have.

Payroll Calendar Templates for 2025-2026 | QuickBooks Canada

Select the Holiday Pay checkbox. Click Done. The next time you create a paycheck for.

How do I setup The Workforce Time Sheets app to identify holidays, and then map that to QBO Elite Payroll so hours worked on holidays flows into the QBO Payroll "Reg Holiday-Worked" column? Make sure you are processing your payroll in time for the holidays with Paycor's Holiday Paycheck Processing Calendar. How to Setup QuickBooks Payroll Holiday Pay? With the introduction of holiday pay attribute in the QuickBooks Payroll software, it has become quite easy for the small business owners to smartly manage the holiday pay of different employees which had been a nightmare for them long ago. In this article, we shall understand in detail about what holiday pay is and how one can set up QuickBooks.

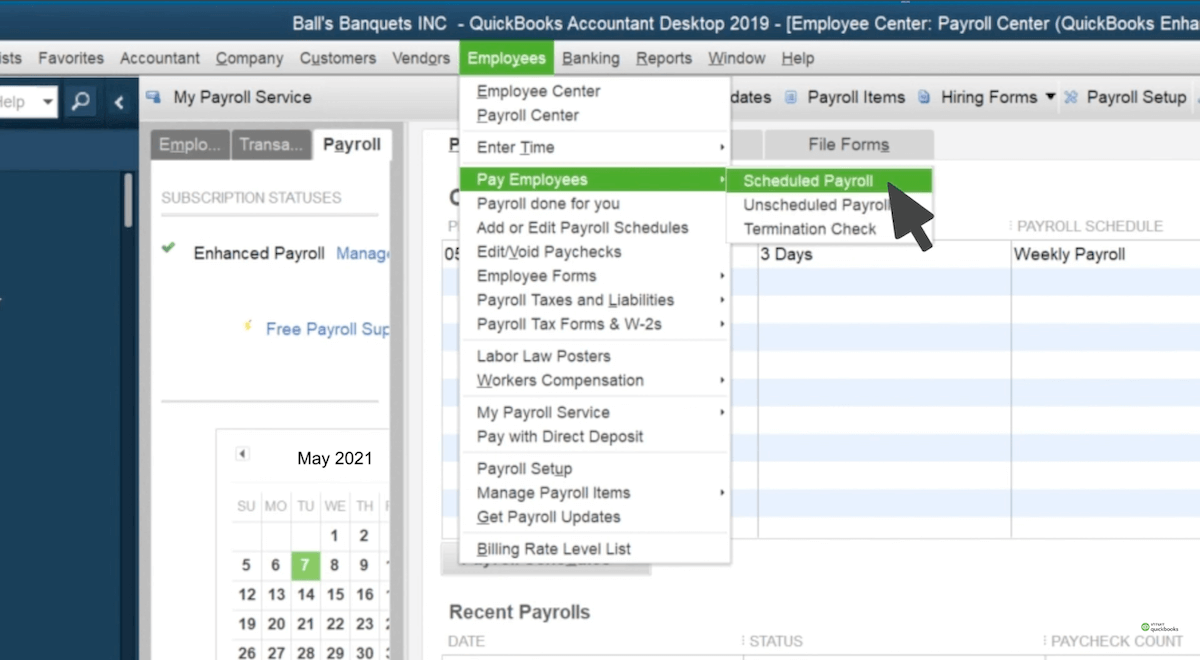

Set up multiple pay schedules in QuickBooks Online Standard Payroll

Manage Employee Holidays in a breeze. A: Yup! Once you set up the policy, QuickBooks will automatically apply it to payroll-no manual entry needed. Just keep an eye on updates in case tax laws change.

Q: What if my employees work on a holiday? A: You can set up premium pay (like time-and-a-half) in the Payroll Items section. Just create a custom pay rate for holiday shifts. Select Regular Pay and click Next.

Type in a Name for the Payroll item, click Next Select expense account from the list (create a new account, if needed). It is recommended to use a separate account the track the Statutory Holiday pay separately. Ensure that Earnings are selected and the Reporting Period is "For which they are paid".