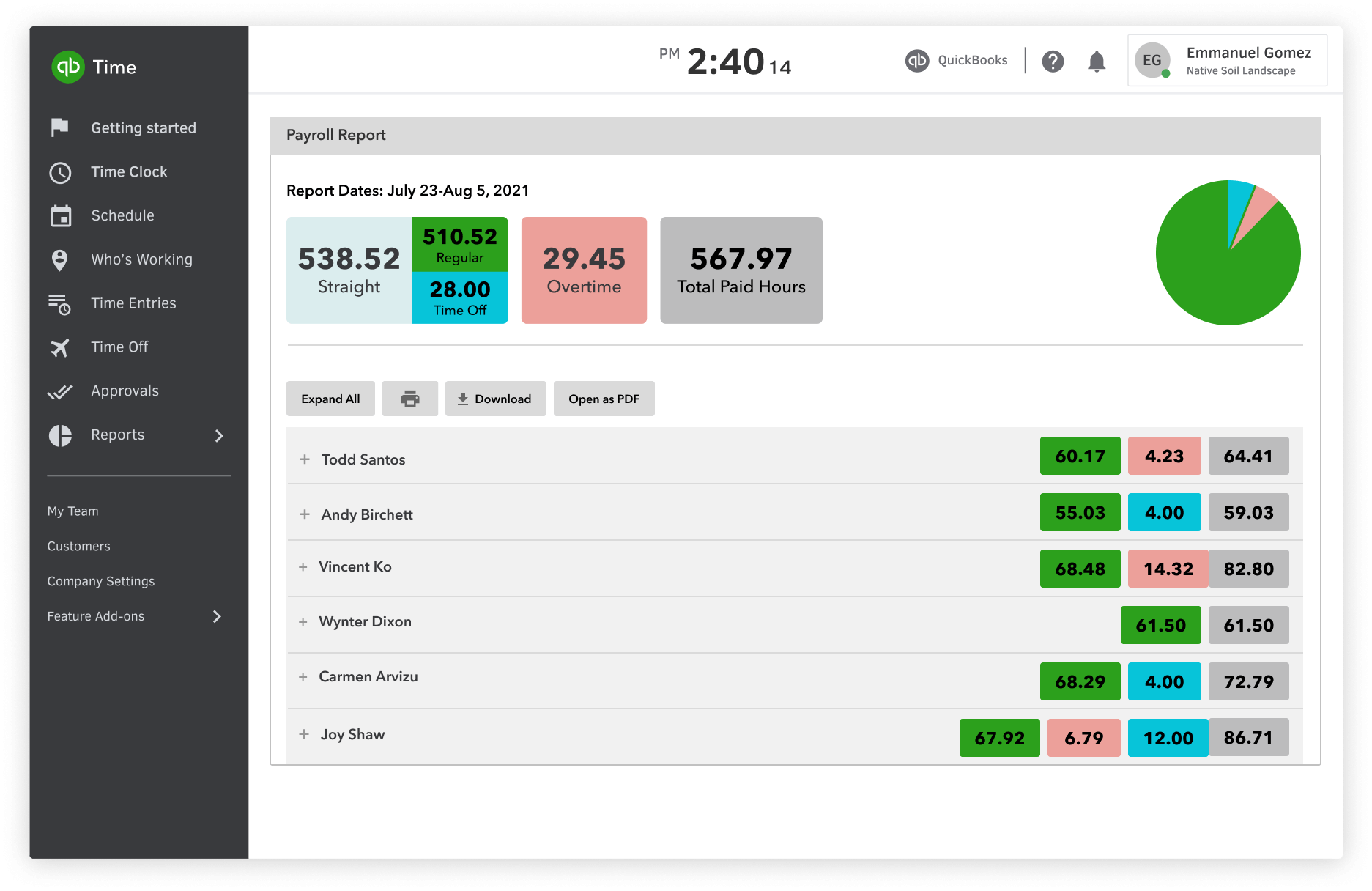

Intuit Payroll Time Report

Go to Reports > Payroll Report. Select the report dates and other filters as needed, and select Run Report. To view details: Select Expand All or select the expand icon (+) next to each name.

To print the report: On the report itself, at the top, select the printer icon. Note: this prints what your current report view looks like. Right-click the report, and select Print ().

Time Tracking for Accountants | QuickBooks

QuickBooks Time lets you track time and save on payroll in one place. Track employee time, jobs, and GPS with our AI-powered, all. Streamline your payroll process with QuickBooks time tracking software.

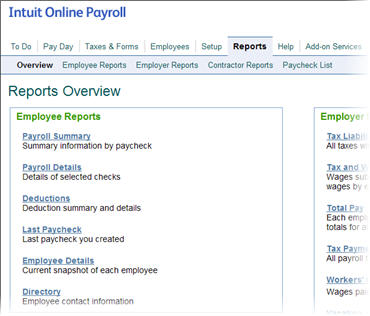

Start your free trial to generate and manage detailed payroll reports with confidence! Intuit, QuickBooks, QB, TurboTax, ProConnect, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing. Reports help you to keep track of payroll details and history.

Employee Time Tracking Software in Intuit Online Payroll

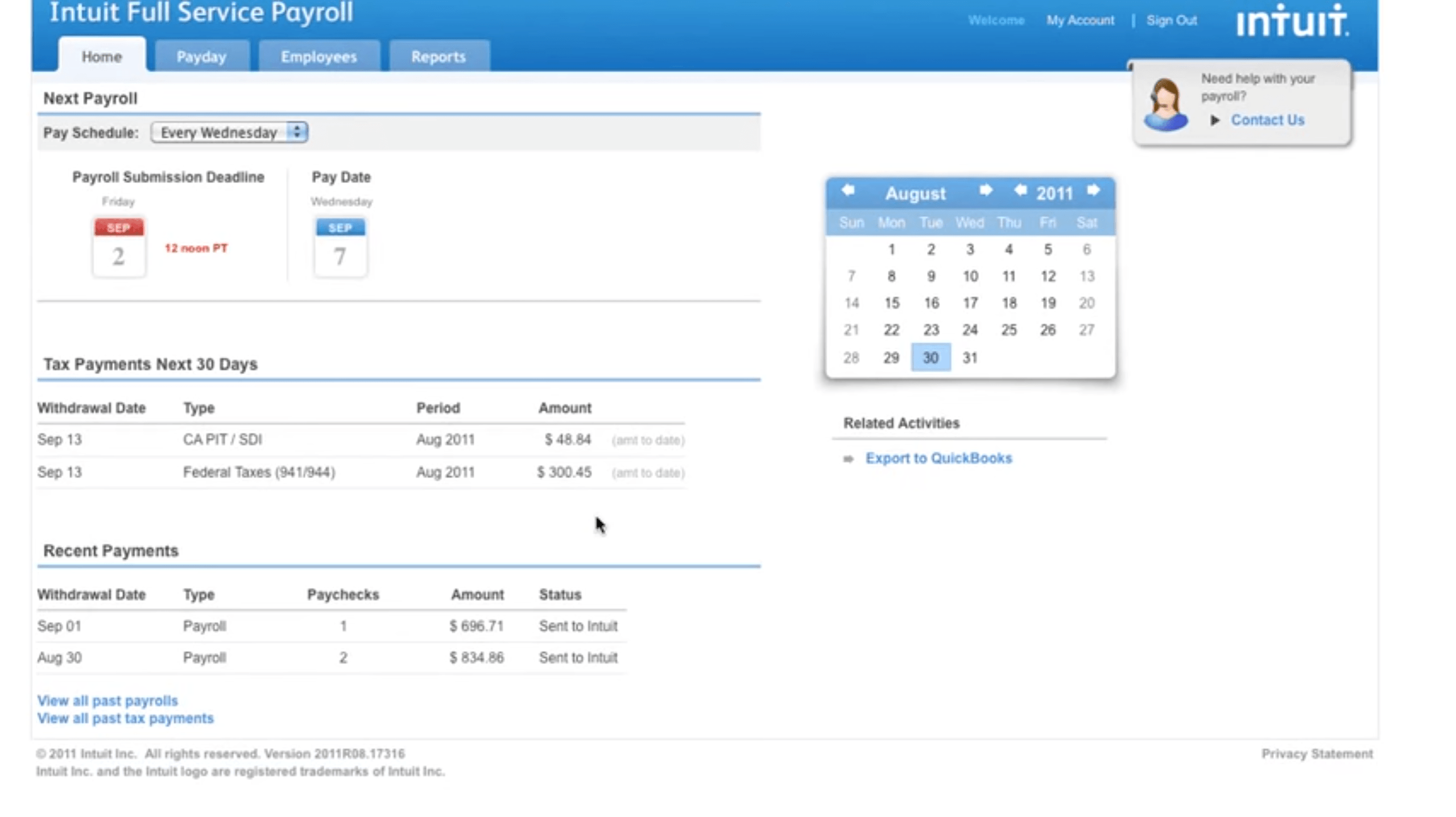

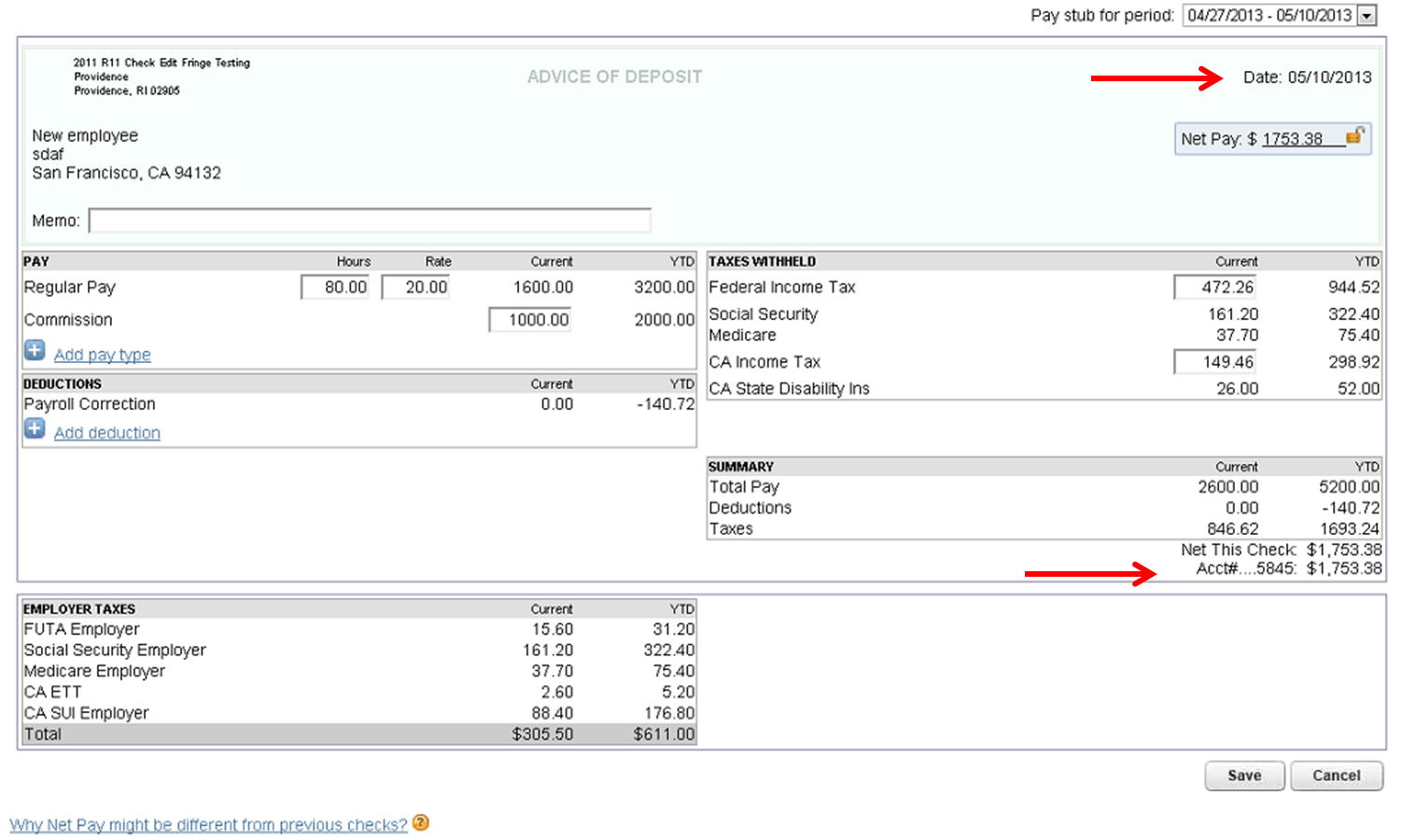

Using reports, you can easily look up past paychecks or previously paid taxes. Looking at payroll reports generated before joining Intuit Payroll? In Intuit Full Service Payroll, these reports will show only YTD totals for each employee. The report shows all the state-related payroll items for each employee.

You can make the report more useful by restricting it to a single payroll item. For example, to see each employee's wagebase for state unemployment insurance, click the Payroll Item drop-down list and choose that payroll item. Each time you choose a different payroll item, the report changes to show employee totals for.

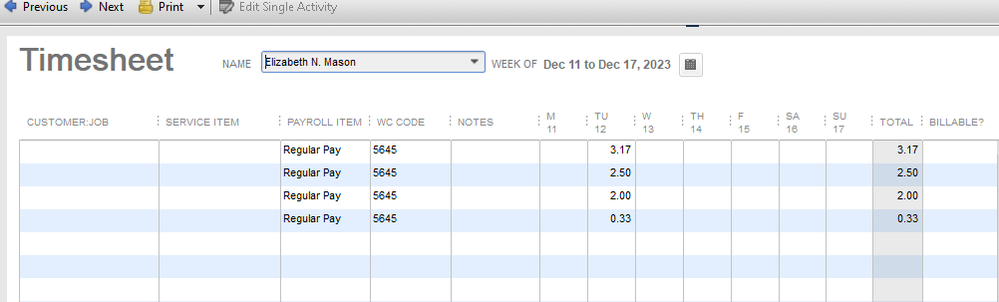

How to stop QuickBooks Payroll from rounding down employee hours?

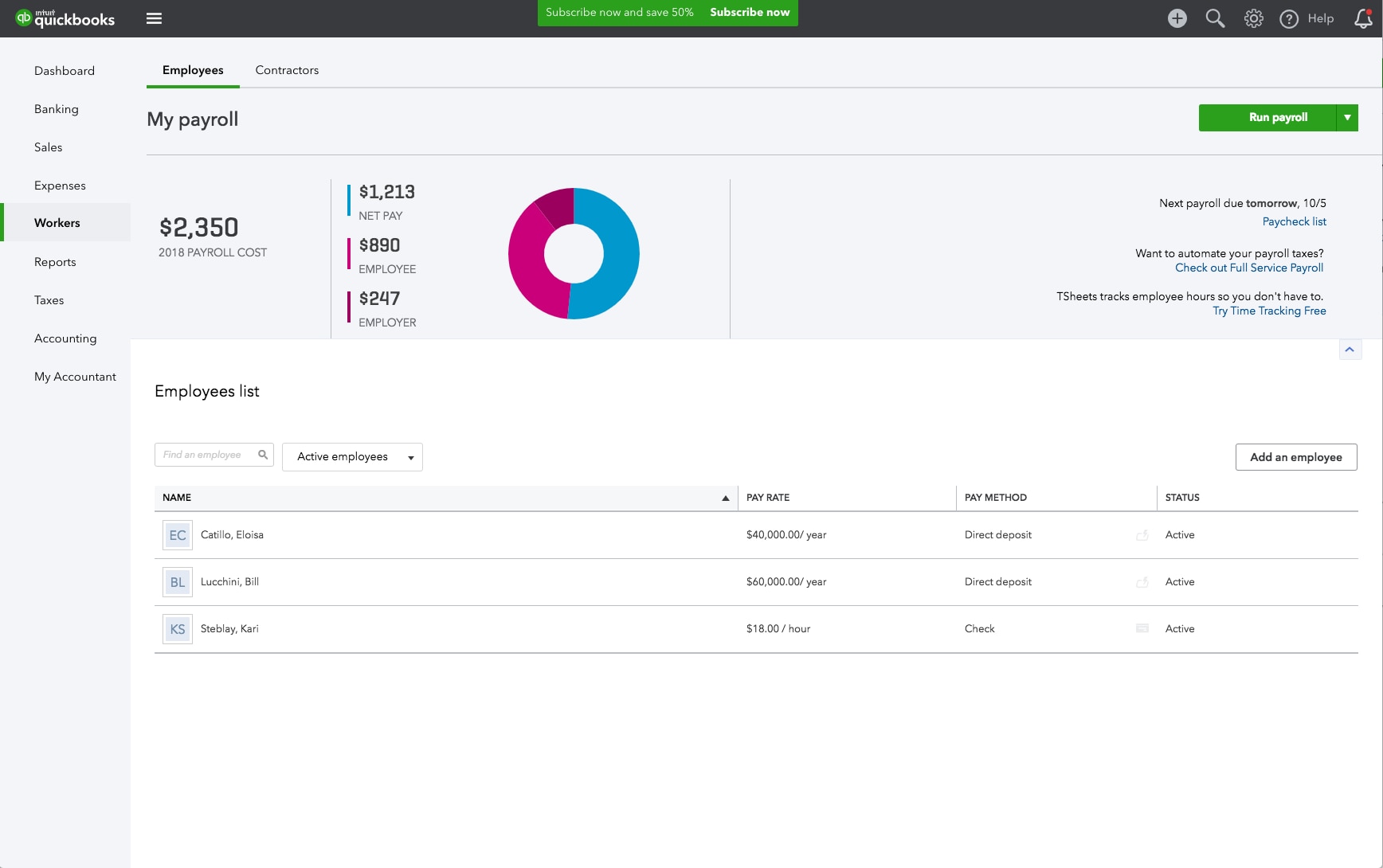

You can add employees, track time, and pay employees using cheques or via direct deposit. You can track and pay your payroll liabilities and create year-end forms like T4's and Records of Employment. QuickBooks lets you manage all of your payroll needs directly within in QuickBooks Online.

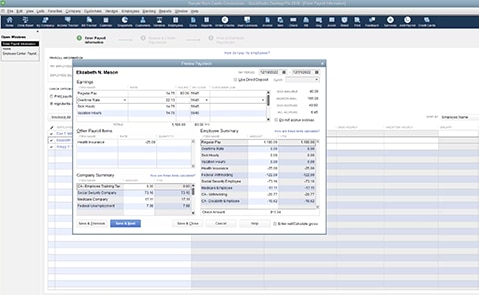

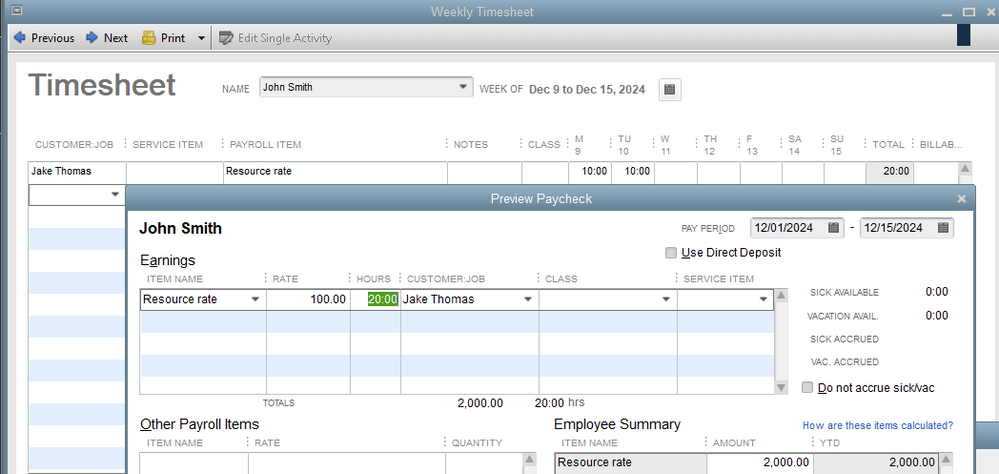

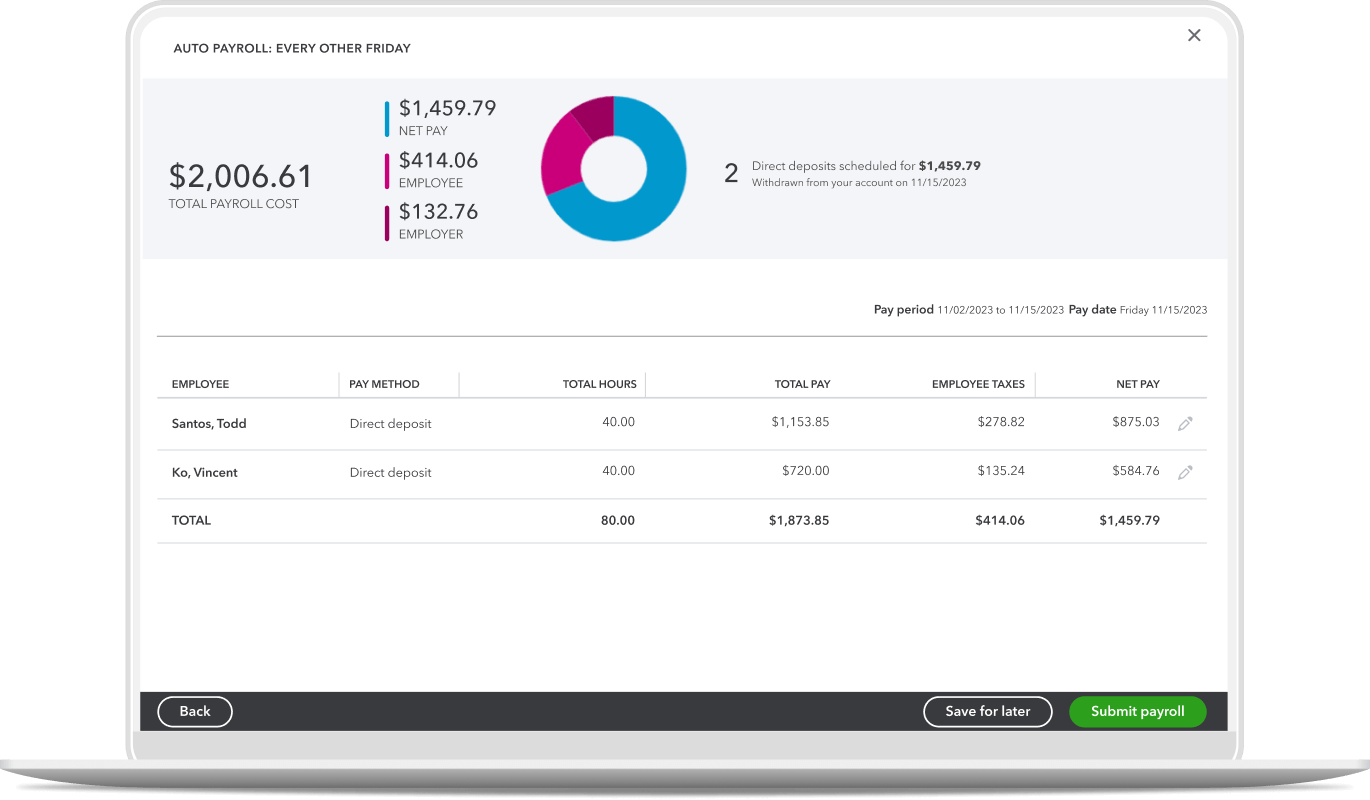

You can expedite your payroll processing with online time tracking. How does time tracking work? Employees enter hours using either online timesheets or an online time clock. When you're ready to run payroll, the hours collected through the time clock or timesheets roll into your Create Paychecks page.

Review the submitted hours and make any necessary corrections, then run your payroll as. An overview of payroll reports available including total payroll taxes paid, employee social security numbers, lists of past paychecks, and more. How to run a report that shows your total payroll cost, including total (gross) employee wages and total employer taxes paid year.