Intuit Payroll Time Off

Set up and track time off in payroll by QuickBooks 598 Updated 5 days ago Set up and Manage Time Off in QuickBooks Time by QuickBooks 172 Updated January 16, 2024 Get started with QuickBooks Desktop Payroll Enhanced by QuickBooks 69 Updated 1 year ago Track and pay New Mexico Paid Sick Leave by QuickBooks 13 Updated 1 week ago Top. Let's learn how to set up time off in QuickBooks, how to account for it when you run payroll, how you can track how much time off employees have left, and how employees can track their time off. Are you using Intuit Online Payroll to process payroll? Need help recording your employees' paid time off policy in Intuit Online Payroll? Watch my video tutorial to find out how to pay your employees PTO in Intuit Online Payroll system.

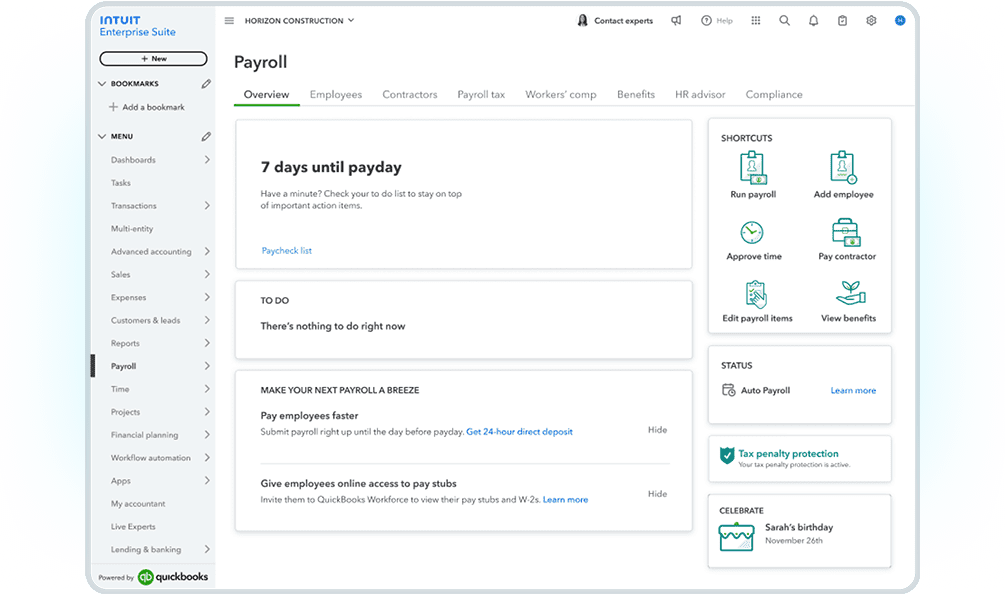

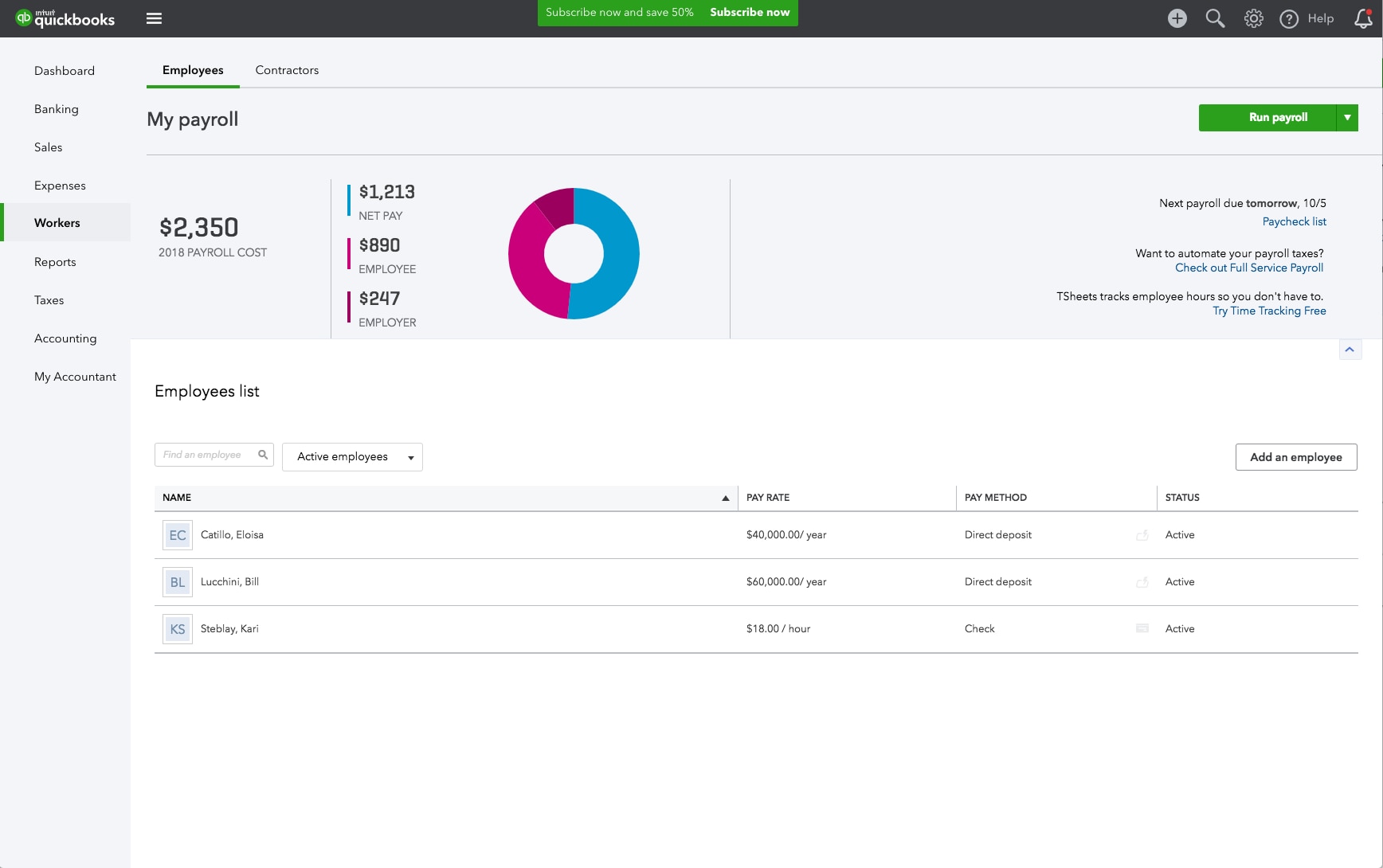

With QuickBooks Online Payroll, QuickBooks Desktop, and Intuit Online Payroll, you\'ll set up and track the time your employees take. First, you'll set up time-off policies like paid or unpaid time off, sick pay, and vacation pay. With QuickBooks Online Payroll and QuickBooks Desktop Payroll, you can set up and track the time your employees take.

Intuit QuickBooks Payroll - Review 2025 - PCMag Middle East

First, you'll set up time-off policies like paid or unpaid time off, sick pay, and vacation pay. If you need to, you can add time off at any point if someone needs more. Intuit payroll needs to know the types of paid time off that employees receive, such as vacation and sick time.

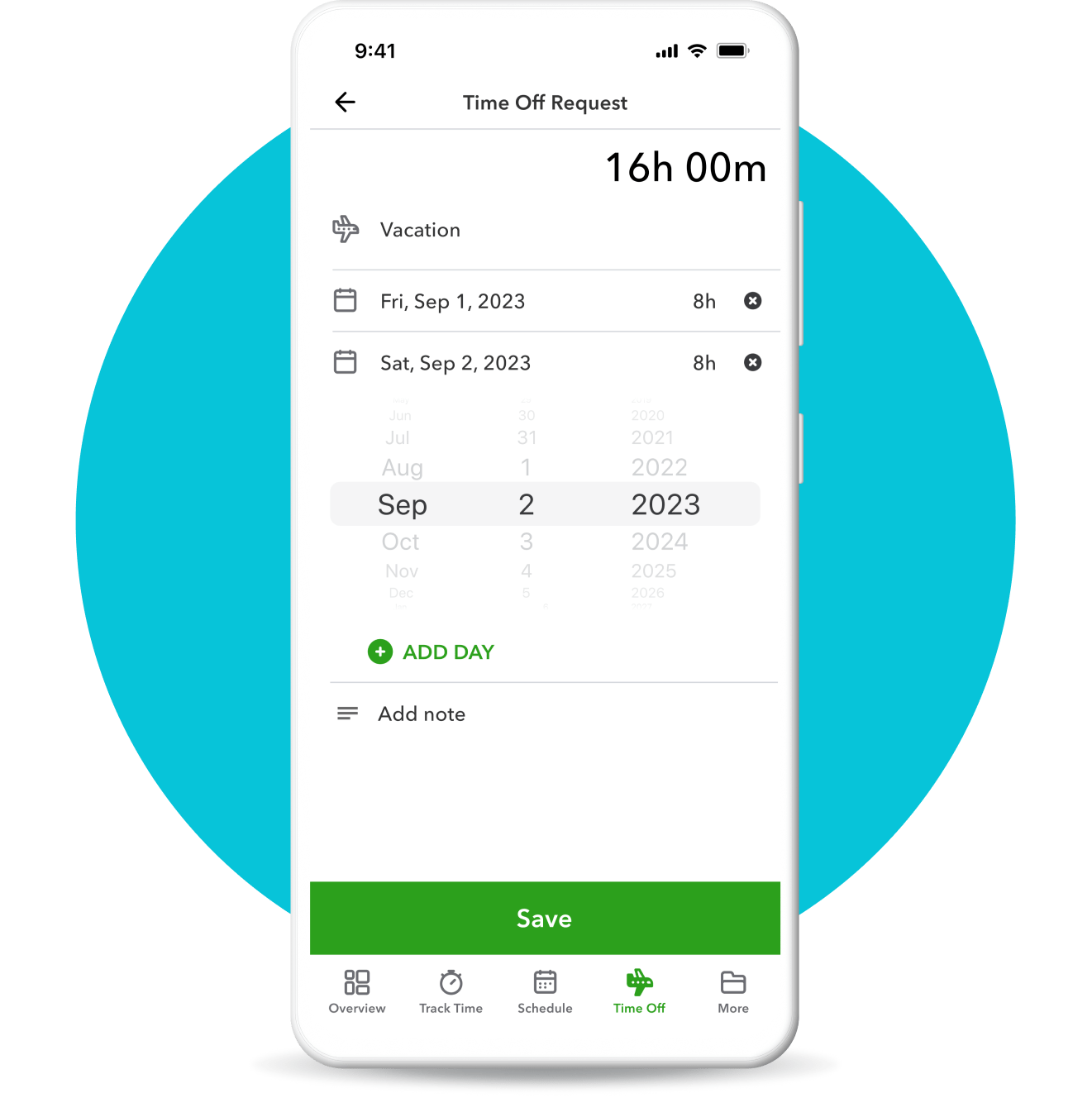

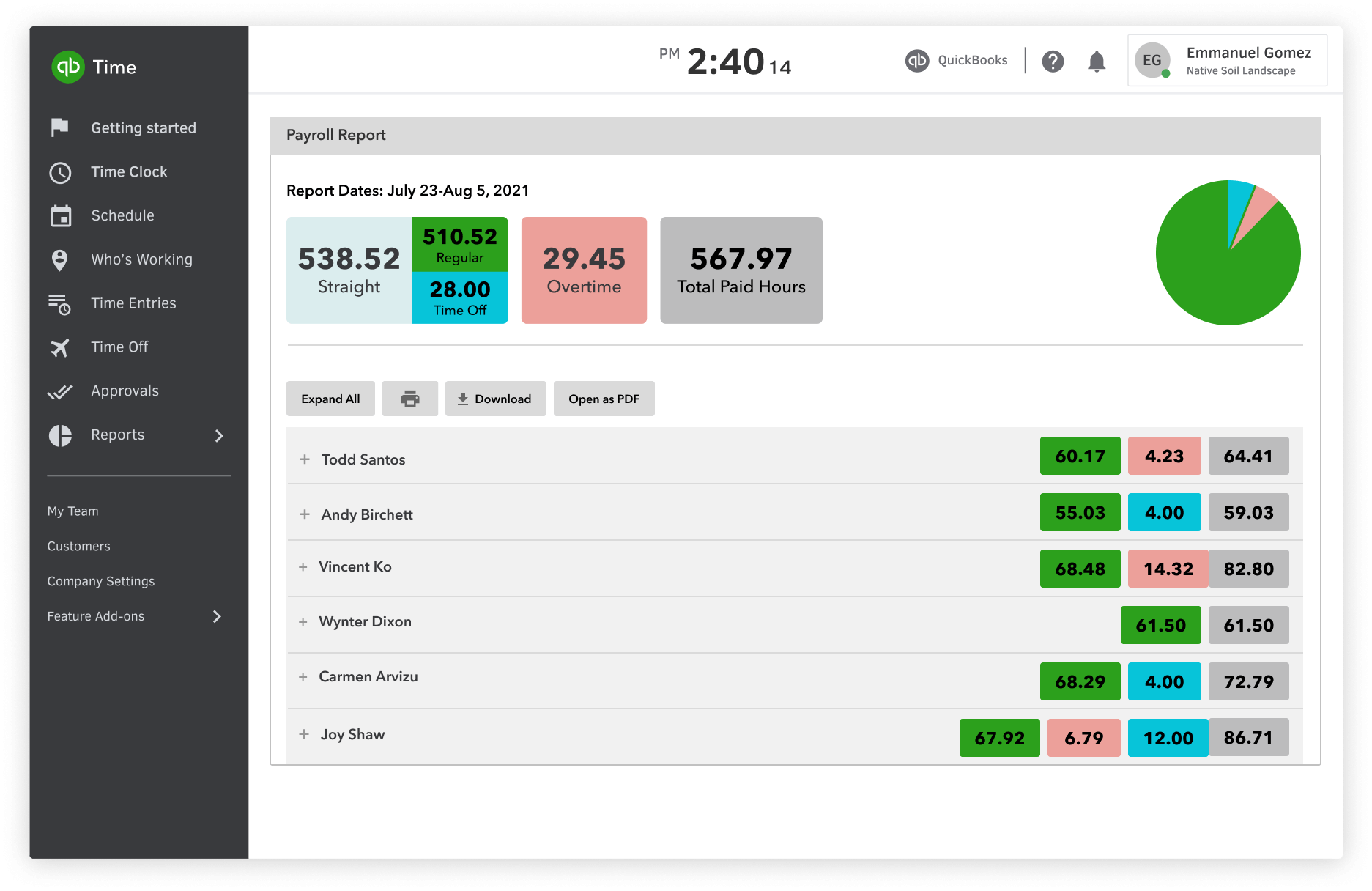

In this video, learn how to create items for the paid time off that your company offers. You can easily request time off in QuickBooks Time using the web dashboard or mobile app. Let's go over how to enter time off requests, check if the request was approved, and see your time off.

Solved: tracking paid time off

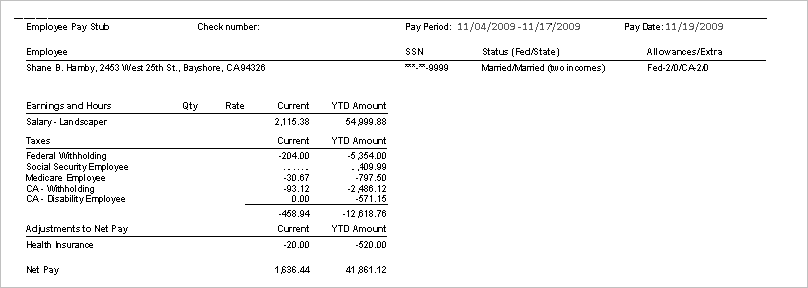

What Vacation & Paid Time Off benefit do Intuit employees get? Intuit Vacation & Paid Time Off, reported anonymously by Intuit employees. One of the questions our clients and training students often ask is "how to record unused paid time off balances as accrued expenses in QuickBooks Online?" This process can be done in six easy simple steps in QuickBooks Online. Recording the accrued unused paid time off balances allows you to capture the expenses at the end of your organization's fiscal year or calendar year.

I need help with tracking time off. The employee has 90 hours of paid time off. What do I need to do to track the time she takes off? Is it done in her paychecks? I read all sorts of comments but none explains what I need to do in QB payroll to note when the employee takes a day off.

Enterprise Workforce Management Automation | Intuit Enterprise Suite

I believe I s.

![How to Conduct a Payroll Audit [+ Free Payroll Audit Checklist] How to Conduct a Payroll Audit [+ Free Payroll Audit Checklist]](https://fitsmallbusiness.com/wp-content/uploads/2019/11/word-image-192.png)